Best Law Firm Accounting Software in 2023

As the backbone of any successful legal practice, accounting and financial management are crucial, but often overlooked, aspects that underpin the functionality of law firms — small and large.

With an industry that bills by the hour and juggles intricate client trust accounts, streamlined financial operations are paramount.

In this article, we’ll explain:

- The Different Types of Law Firm Accounting Software

- The Relationship Between Practice Management and Accounting

- How to Decide Between Server-Based or Cloud-Based Software

- Law Firm-Specific Accounting Features to Prioritize

- Our List of the Top Law Firm Accounting Software in 2023

Whether you’re a seasoned legal professional or someone just breaking into the sector, understanding the pivotal role of these digital tools will only elevate your firm’s performance and client trust.

In This Article

- Introduction to Law Firm Accounting Software

- The Types of Accounting Software

- Accounting vs. Practice Management Software: The Differences and the Overlap

- Law Firm Accounting Software Features

- Server-Based vs Cloud-Based Software

- The Top Accounting Software For Law Firms – Our List

- More Useful Software for Law Firms

- Frequently Asked Questions - Law Firm Accounting Software

Introduction to Law Firm Accounting Software

Accounting is an essential function of any business, and law firms are no exception. However, law firms have unique needs when it comes to accounting.

Most law firms need:

- General / Business Accounting

- Trust / IOLTA Accounting

- Cash Basis (vs. Accrual)

- Multiple Billing Types (Hourly, Fixed Fee, Contingency)

- Law Firm-Centric Financial Reporting

Today there are many options available for law firm accounting.

So many, it can be daunting, and outright confusing (especially given the mix and overlap of some law firm accounting software and law practice management software.)

Types of Law Firm Accounting Software

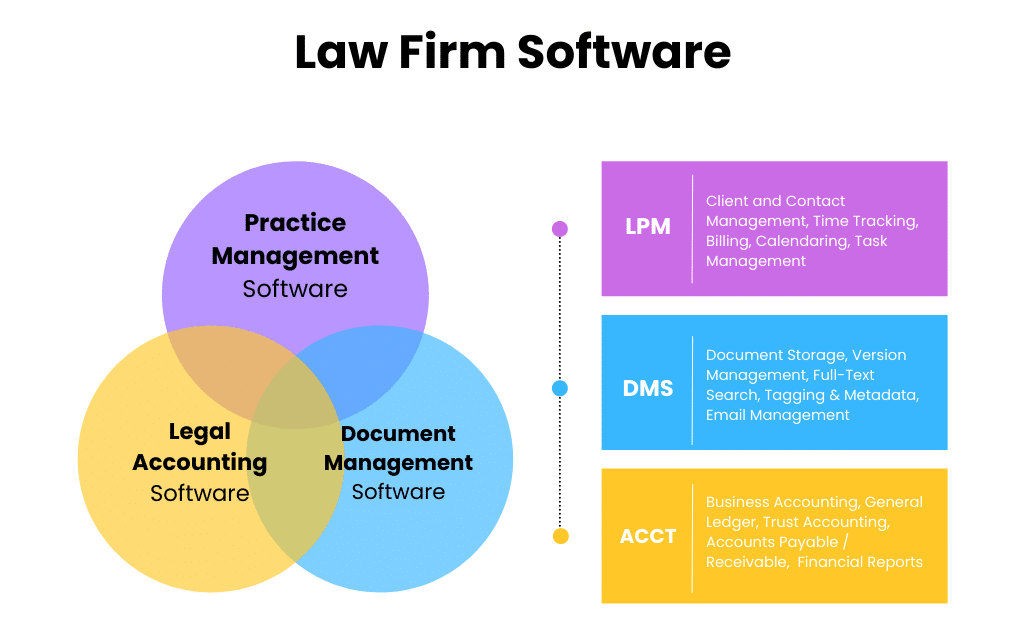

A common point of confusion are the different types of law firm accounting software.

The term “law firm accounting” tends to be thrown around pretty liberally, and is often (inaccurately, in our view) used to describe billing and trust features.

However, they lack the core/traditional accounting software fundamentals (like a Chart of Accounts, P&L, Balance Sheet).

In addition, there is general-purpose accounting software (that is: accounting software meant to be used by any type of business, but does not necessarily include the law-firm-specific functions that you may need.)

To provide clarity, in our list of the best law firm accounting software, we’ll define each software product as one of three classes:

- Pure Accounting Software (Usually Industry-Neutral)

- Practice Management + Accounting Software

- Dedicated Legal Accounting Software

As a first step towards finding the right law firm accounting software for your firm, consider whether you want accounting functions built into your law practice management software or if you prefer to keep accounting and case management functions mostly separate.

While you’re building the technology stack for your law firm, don’t forget to ensure you have the best document management system.

If you have a cloud-based document management system, like LexWorkplace, you may find that it’s easier to coordinate and integrate your legal software.

Bring Law and Order to Your Documents

LexWorkplace Includes:

- Document Profiling / Metadata

- Structured by Client/Matter

- Organize With Folders and Tags

- Save Emails to Matters

- Built-In Version Management

- Add Notes to Docs & Email

Accounting Software vs. Practice Management Software (The Differences and the Overlap)

Accounting Software vs. Practice Management Software (The Differences and the Overlap)

Law Practice Management, Billing, and Accounting are three related but discreet functions. Each can be managed with different software (or in an all-in-one software suite).

This is where the fuzzy terminology makes understanding what any given software package does confusing.

Law Practice Management Software

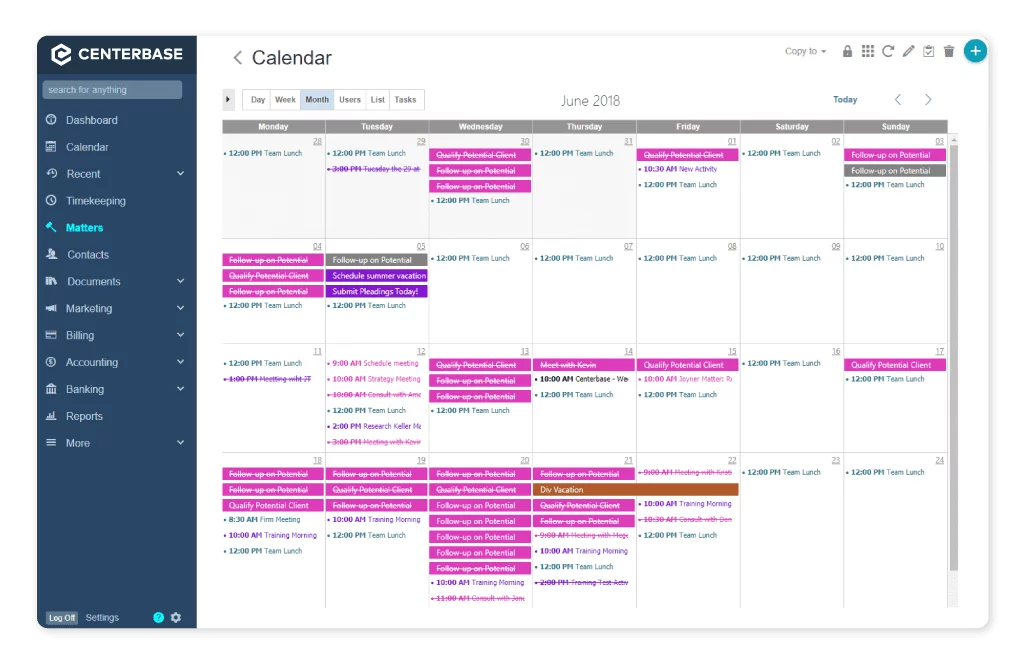

Generally speaking, Practice Management software (AKA Case Management Software) handles a law firm’s:

- Clients and Contacts

- Case/Matter Management

- Calendaring

- To-Do/Workflow

- Time Tracking

- Billing

Law Firm Accounting Software

Full accounting software, typically provides:

- Chart of Accounts / General Ledger

- Profit & Loss / Balance Sheet

- Ledgers for Bank Accounts / Operating Accounts

- Invoicing

- Asset Management

Both of these lists are abbreviated, but you’ll see that these are fundamentally different, but related, functions.

Here’s the key:

Some Practice Management applications include complete accounting (including everything you see above), and some practice management applications provide time tracking, billing, and expense tracking…

But leave the actual accounting to separate software (which it may integrate with).

Law Practice Management applications like Clio, Practice Panther and Time Matters do provide time tracking, billing and even reporting on billings…

But they do not provide the “rest of accounting,” and instead integrate with applications like QuickBooks to complete the picture.

This is not to say one method is better than the other; rather it makes defining and understanding the classes of law firm accounting software important.

Related – Top Law Firm Software: Practice Management, Document Management, Accounting, and more.

Sidebar: Legal Document Management

Accounting software is an essential part of any law firm’s legal tech toolbox.

In addition, your firm may need to supplement your other legal software with a dedicated Document Management System to securely manage firm documents and email.

You might consider LexWorkplace, document management software born in the cloud, built for law firms.

- Securely Store & Manage Documents in the Cloud

- Client/Matter-Centric Document Organization

- Full-Text Search Across All Documents & Email

- Outlook Add-In: Save Emails to Matters

- Work with Windows and Mac OS

Considering LexWorkplace?

Watch This LexWorkplace Success Story

See how one law firm uses LexWorkplace to organize their documents and streamline their practice.

Book a 15-Minute Demo

Server-Based vs Cloud-Based Software

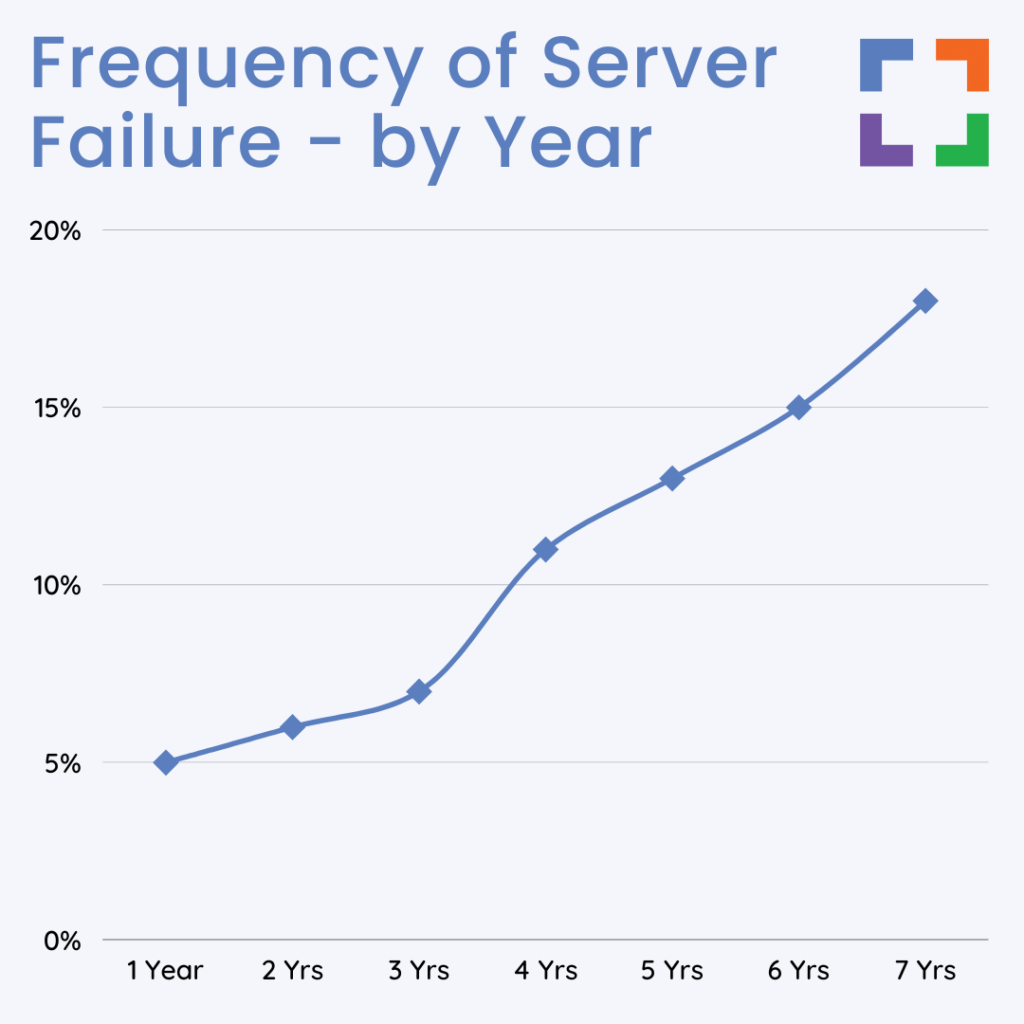

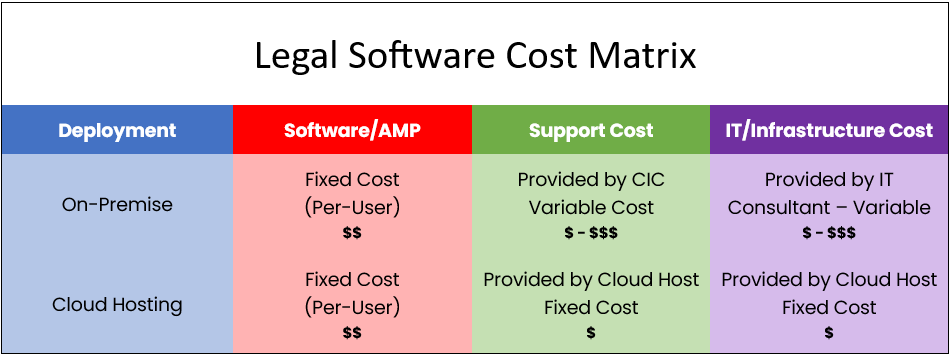

When considering law firm accounting software, the choice between server-based and cloud-based solutions is pivotal.

Both have their merits, but evolving technological landscapes and changing work dynamics are shaping preferences.

Server-Based Solutions

Server-based software is installed and runs on in-house servers, and users access it through the firm’s internal network.

Let’s look at some of the pros and cons of server-based software.

PROS

- Control and Customization: With a good IT department, firms have direct control over their servers and can customize the software to suit their specific needs.

- Robust Software: Server-based solutions often offer robust and comprehensive features, allowing for intricate customization and advanced functionalities.

CONS

- Limited Accessibility: Access is typically restricted to the office premises, hindering flexibility and remote access to data and applications.

- Scalability and Updates: Scaling up requires additional hardware purchases, and software updates can be cumbersome, often requiring downtime.

- High Initial and Ongoing Costs: Server-based solutions require substantial upfront investments in hardware, installation, and maintenance.

Cloud-Based Solutions

Cloud-based software is hosted on external servers and accessed via the internet, offering a more modern approach to data management.

Let’s look at the pros and cons of this type of software.

PROS

- Accessibility and Flexibility: Cloud-based solutions like LexWorkplace allow users to access data and applications from anywhere, fostering a flexible and collaborative work environment.

- Cost-Efficiency: With subscription-based pricing and minimal hardware requirements, firms can optimize costs and allocate resources more efficiently.

- Enhanced Security and Backups: Reputable cloud providers implement robust security measures and regular backups, ensuring data integrity and availability.

- Seamless Integration and Updates: Integration with other legal tools is streamlined, and software updates are automatic, reducing downtime and maintaining optimal performance.

CONS

- Dependence on Internet Connectivity: A stable and robust internet connection is crucial for uninterrupted access to cloud services.

- Data Control: Firms might have concerns about relinquishing control over their data to third-party providers, although this is mitigated by choosing reputable providers with stringent security measures.

As you see, while server-based solutions sometimes offer more control and robustness, the scalability, flexibility, and cost-efficiency of cloud-based solutions are increasingly making them the preferred choice for law firms.

LexWorkplace, as a cloud-based document management system, exemplifies the advancements in cloud technology, offering secure, accessible, and integrated solutions tailored for the legal industry.

By embracing cloud-based solutions like LexWorkplace, law firms can navigate the digital transformation journey more effectively, ensuring sustained growth and enhanced client service.

Law Firm Accounting Software Features

Next, we recommend that your firm makes an inventory of the specific capabilities and features that you require in your law firm accounting software. For this, you should confer with both your legal team and your accountant.

Features that are often, but not always, available in law firm accounting software include:

- Chart of Accounts

- Bank/Operating Account Management

- Online Banking Integration

- Credit Card Management

- Loan/Line of Credit Management

- Expense Tracking

- Inventory/Asset Management

- Time Tracking

- Billing/Invoicing

- Profit & Loss Statement

- Balance Sheet

- Cashflow Statement

- Tax Reporting

- Bank Account Reconciliation

- Trust Accounting

- Amortization Functions

Consider whether your firm would be best suited for combined practice management / accounting software (or separate software for each), and consider the specific features your law firm needs.

Then, you’re ready to evaluate the top accounting platforms for law firms.

Need help deciding? Book some time for a consultation, and our support staff is happy to give advise you in the best direction to go.

LexWorkplace Top Features

Cloud-based Document Management

- Secure Cloud Storage

- Client/Matter-Centric Org

- Full-Text Document Search

- Secure Client Sharing

- MS Office Add-In

- Email Management

- Windows + Mac Compatible

The Top Accounting Software For Law Firms – Our List

In our extensive experience working with hundreds of law firms, here is our list of the best law firm accounting software (in no particular order).

Server-Based Software

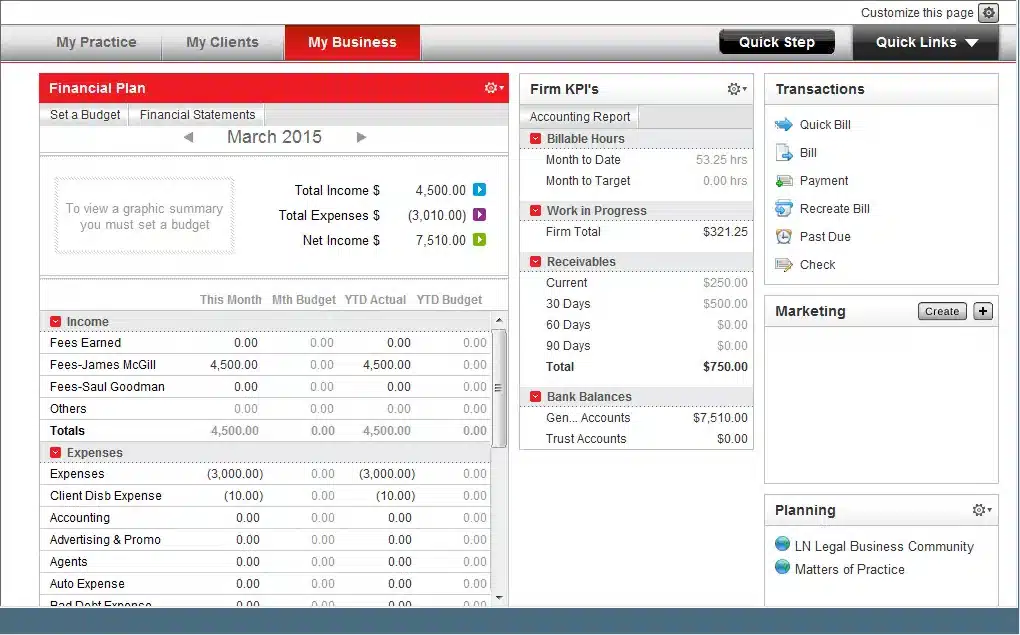

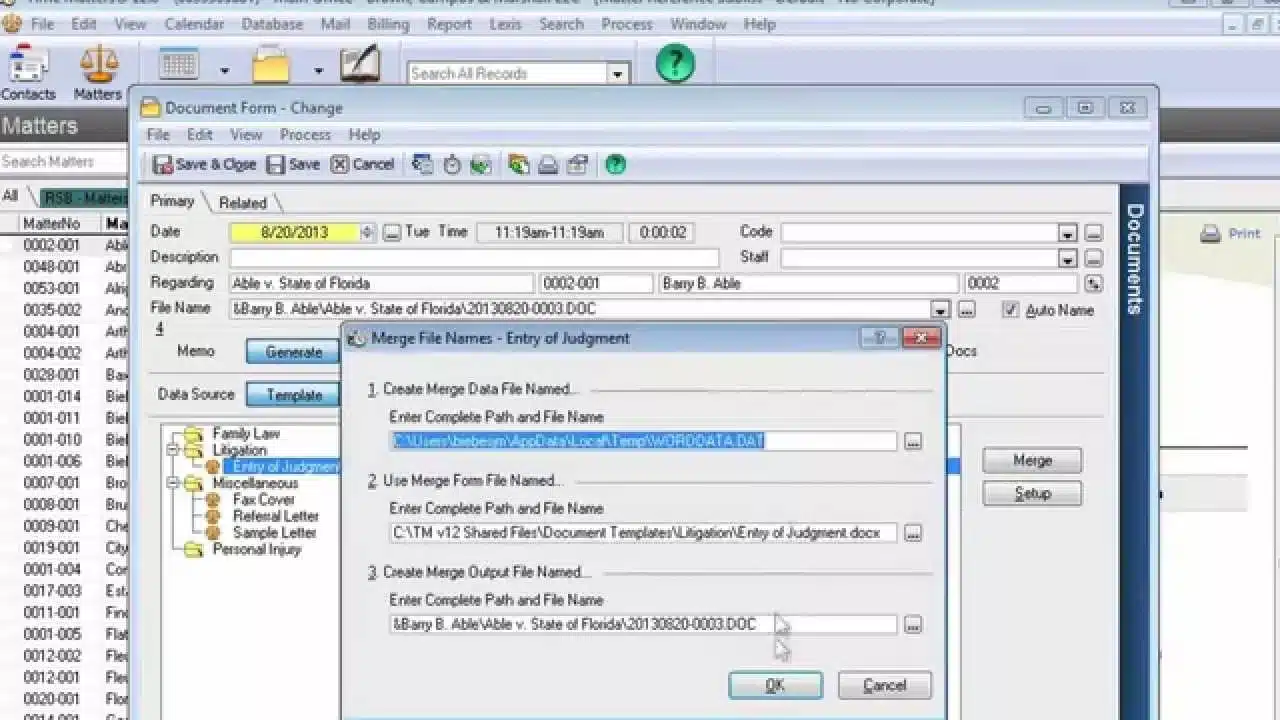

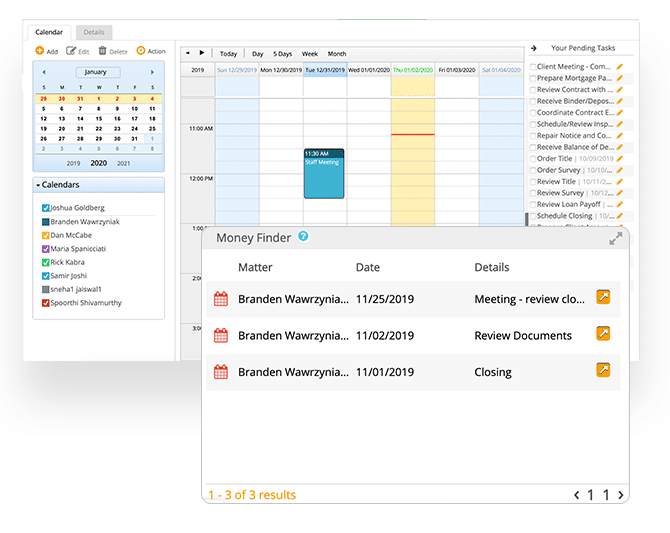

PCLaw

Company: PCLaw|Time Matters

Software Class: Accounting + Practice Management

OVERVIEW

PCLaw is a popular, long-standing practice management, billing and accounting solution for small and midsize law firms. It includes lightweight practice management (clients, cases and calendars), coupled with robust time tracking, billing and accounting (including robust financial reporting). While PCLaw is thought of as law practice management software, accounting is deeply embedded into the product.

You can think of PCLaw as a strong accounting foundation, with lightweight law practice management features built on top. PCLaw is easy to get up-and-running with. And if your law firm needs more comprehensive case and document management, PCLaw integrates with Time Matters.

PCLaw is desktop/server-based, so it can be run on-premise or within a Private Cloud.

STAND-OUT FEATURES

- Rapid Setup: Easy to Implement Without a Consultant

- Fully-integrated Accounting (Business & Trust)

- Simple, Straight-forward Case Management

- Tight Integration with Time Matters

PRICING

- Subscription-based Pricing Per-User Available

- Contact Vendor for Details

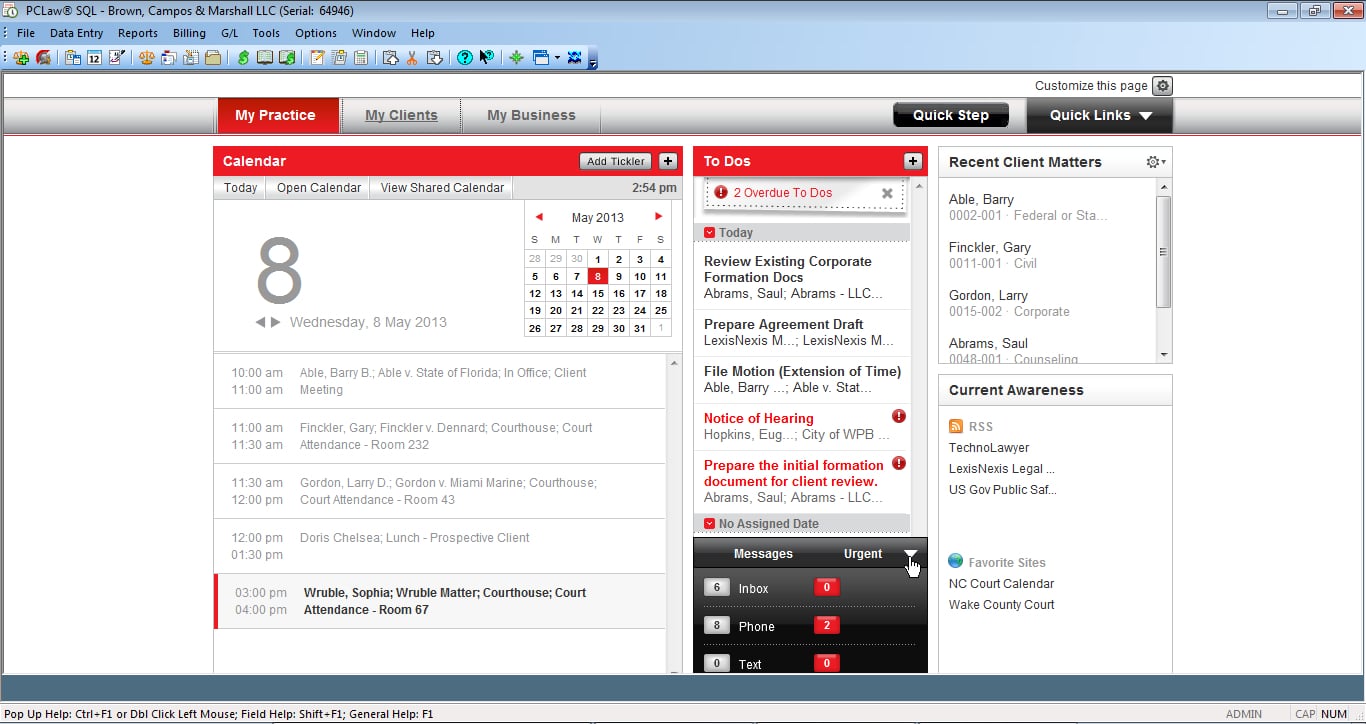

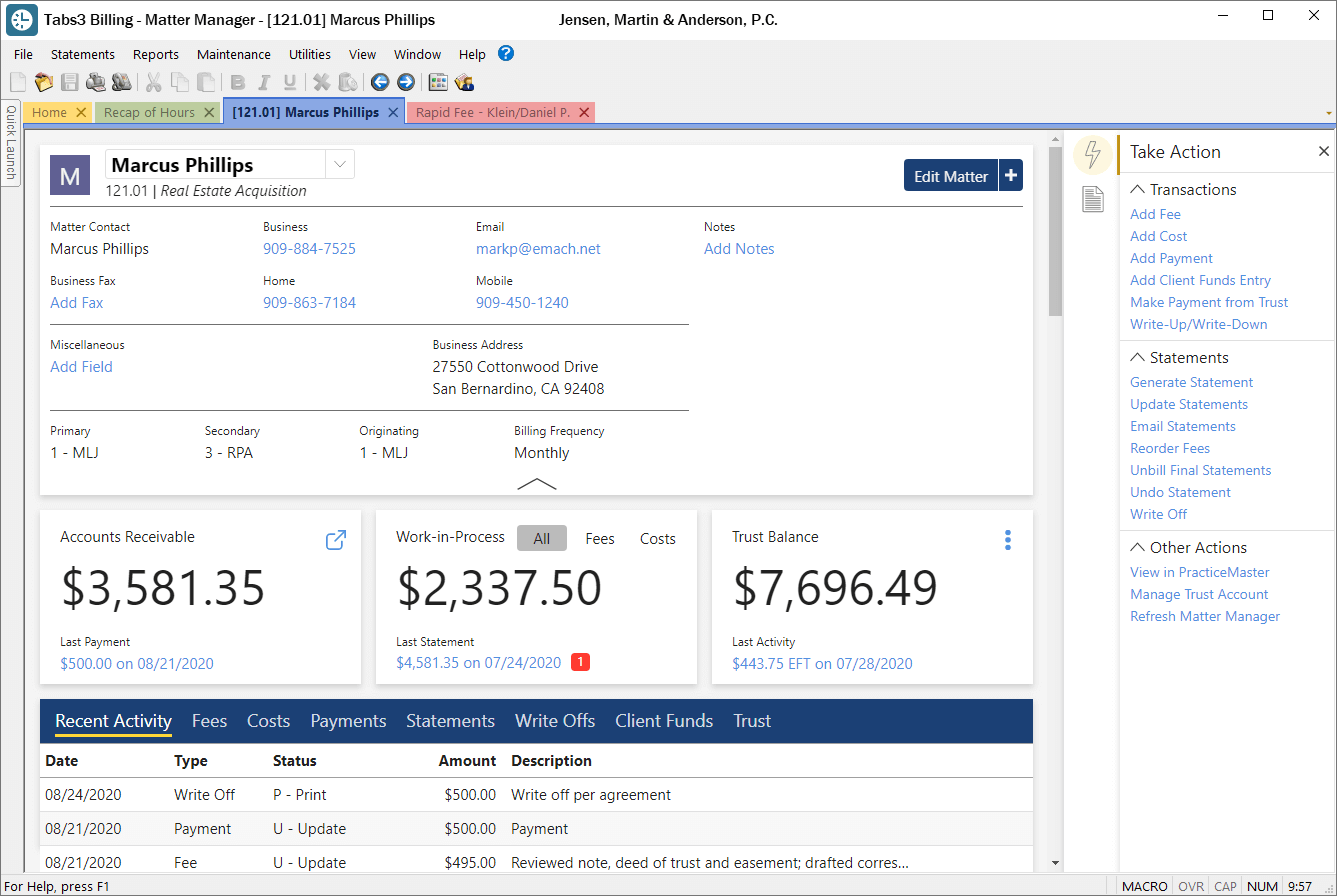

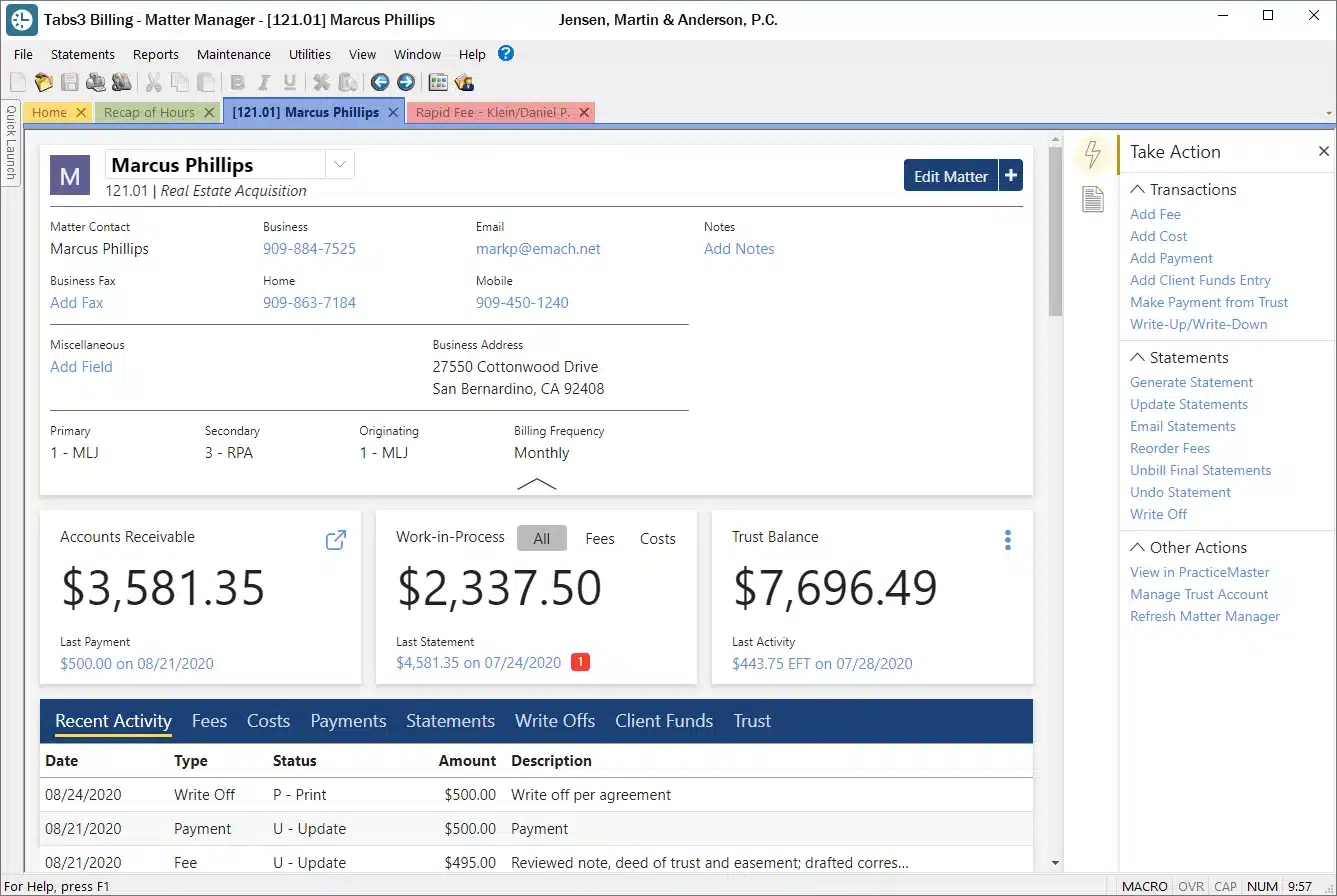

Tabs3

Company: Software Technology, Inc.

Software Class: Accounting + Practice Management

OVERVIEW

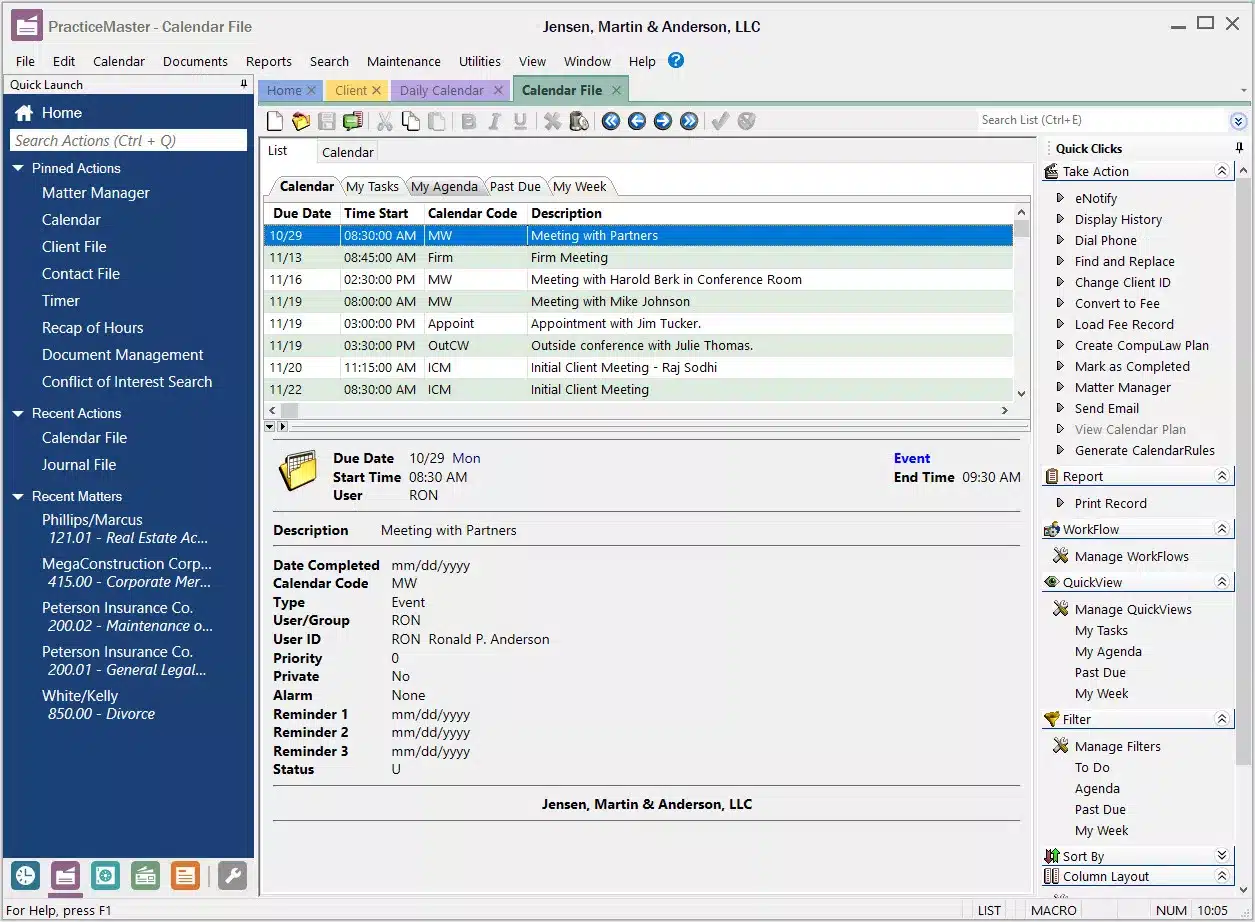

Tabs3 is robust legal billing and accounting software. Tabs3 is part of the Tabs3 / PracticeMaster suite of law firm software. Tabs3 provides essential “back-office” functionality including time, billing and accounting; PracticeMaster provides powerful “front-office” capabilities including client and matter management.

Tabs3 has been around a long time, and has a reputation for being a robust accounting platform, backed by excellent user support.

Tabs3 is desktop/server-based, so it can be run on-premise or within a Private Cloud.

STAND-OUT FEATURES

- Modular Suite of Front-Office/Back-Office

- Best-in-Class Customer Support

- Strong Network of Authorized Consultants

PRICING

- Based on Total Users and Timekeepers

- See vendor’s Price Calculator

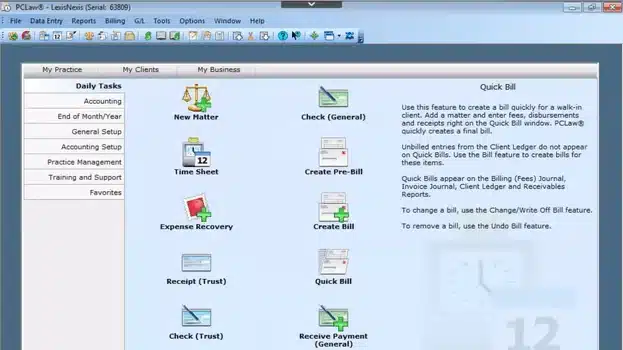

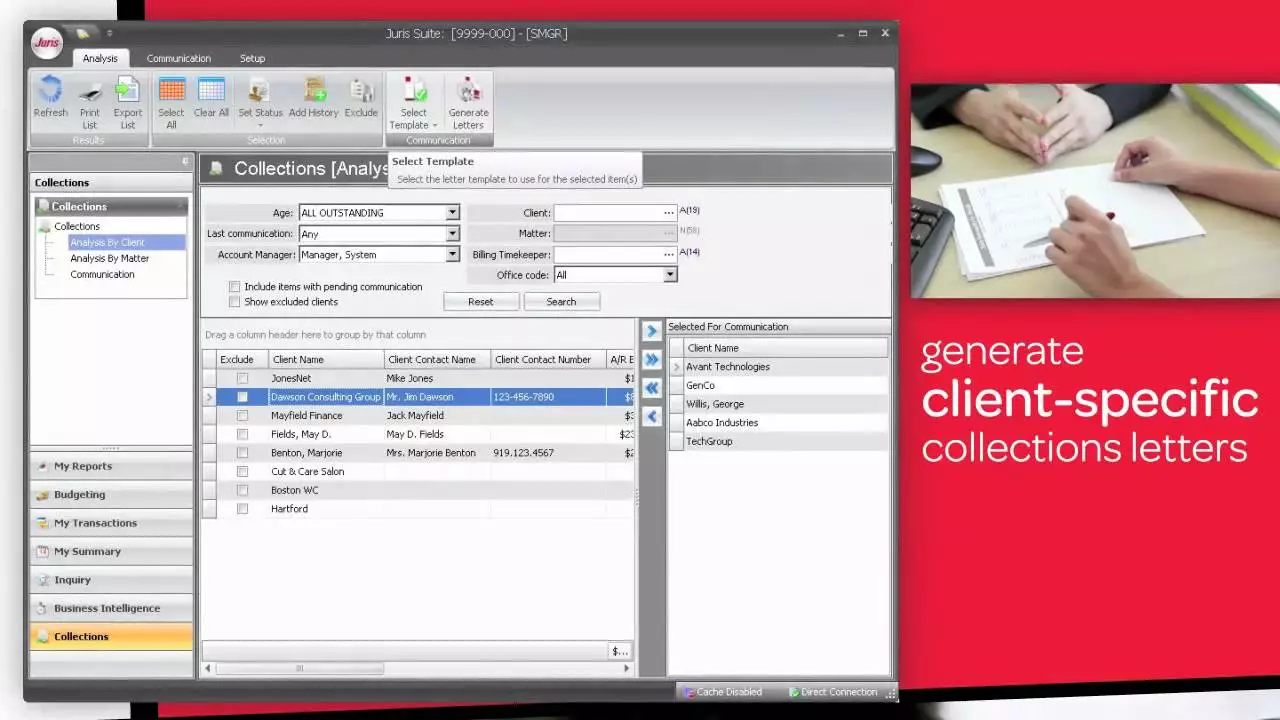

Juris

Company: LexisNexis

Software Class: Dedicated Legal Accounting

OVERVIEW

Juris is a robust law firm billing and accounting platform. It’s incredibly robust and flexible, making it a top choice for law firms of 10 time-keepers or more. Juris provides full-fledged accounting as well as nuanced, detailed billing for a variety of billing models.

Juris comes in two packages, Juris Core (it’s more entry-level product) and Juris Suite, it’s more comprehensive edition. Both come with rich accounting and a strong set of financial and billing reports.

Juris is desktop/server-based, so it can be run on-premise or within a Private Cloud.

STAND-OUT FEATURES

- Rich Accounting Feature Set

- Robust Billing System, Flexible Options

- Integration with Time Matters for Practice Management

PRICING

- Based on Users and Edition (Core/Suite)

- Contact Vendor for Details

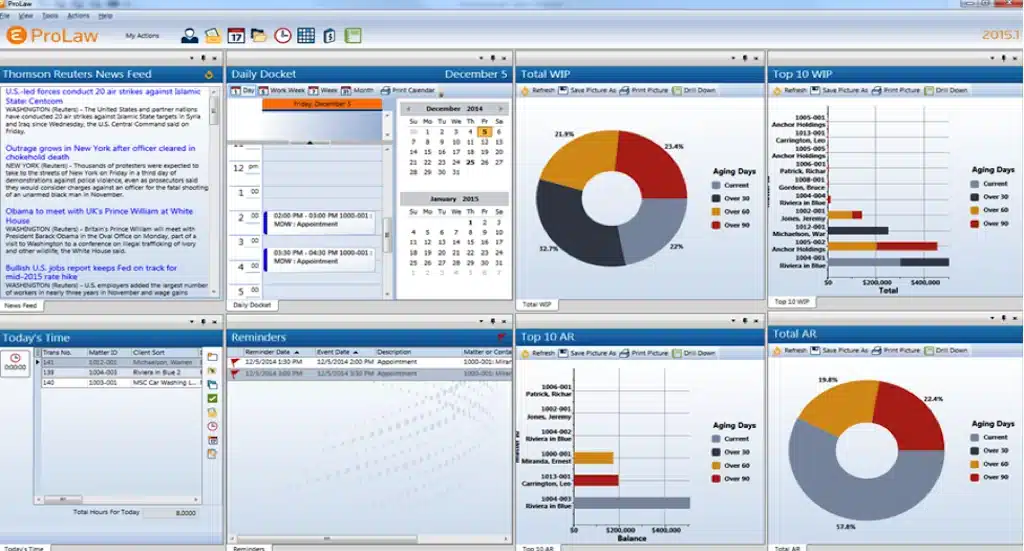

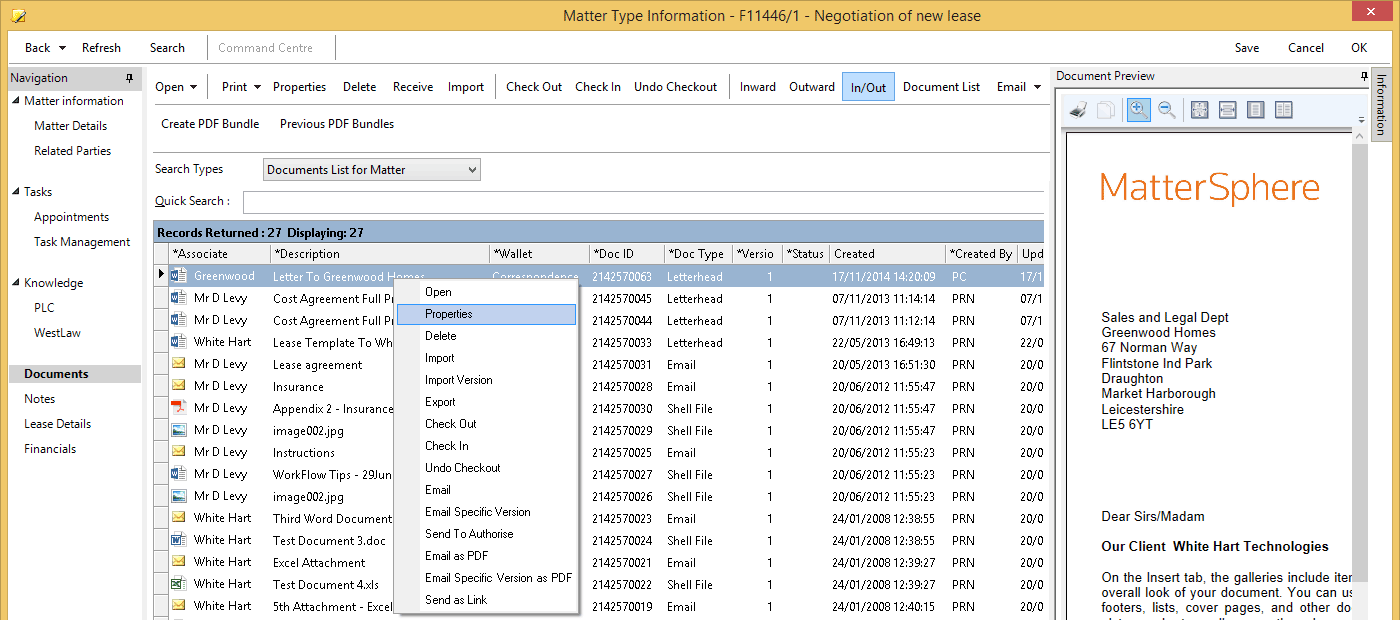

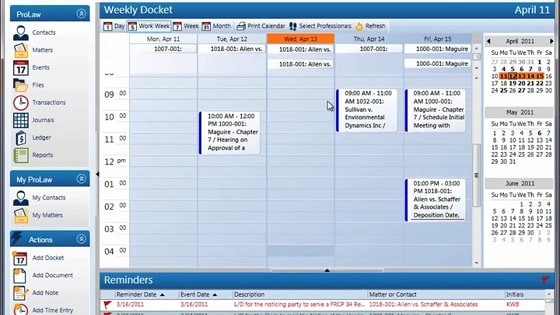

ProLaw

Company: Elite (a Division of Thomson Reuters)

Software Class: Practice Management + Accounting

OVERVIEW

ProLaw is robust practice management, document management and accounting software for law firms. It’s the only legal software platform that includes all three of these main pillars to running a law practice.

ProLaw comes in a number of packages and editions, some of which include ProLaw’s fully-featured accounting software. With ProLaw, your law firm can manage its clients, matters, billing, documents and accounting on a single package.

ProLaw is desktop/server-based, so it can be run on-premise or within a Private Cloud. ProLaw also offers ProLaw Workspace, an optional web interface to the ProLaw system.

STAND-OUT FEATURES

- End-to-End Solution: LPM, DMS and Accounting

- Rich Integration with Microsoft Office

- Streamlined, Modern User Interface

PRICING

- Pricing varies by firm

- Starts at 10-User Package

Consider the Cloud

Perhaps you want to use a server-based software, but you don’t want the hassle of server ownership/maintenance — understandable!

Regardless of which accounting software best suits your law firm’s needs, Uptime Practice wants to help you host it.

A Private Cloud will host your desktop-based legal software, documents and data in the cloud. Get the reliability, security and mobility of the cloud without sacrificing your software. Get in touch with our team to learn more.

Move Your Legal Software to the

Cloud with Uptime Practice

- Cloudify Your Legal Software

- Expert Legal Software Hosting/Support

- Cloud Storage for Documents + Data

- End-to-End Security

- Office 365 + IT Support (Optional)

Related – Private Cloud for Law Firms: Eliminate Servers. Work Anywhere.

Cloud-Based Software

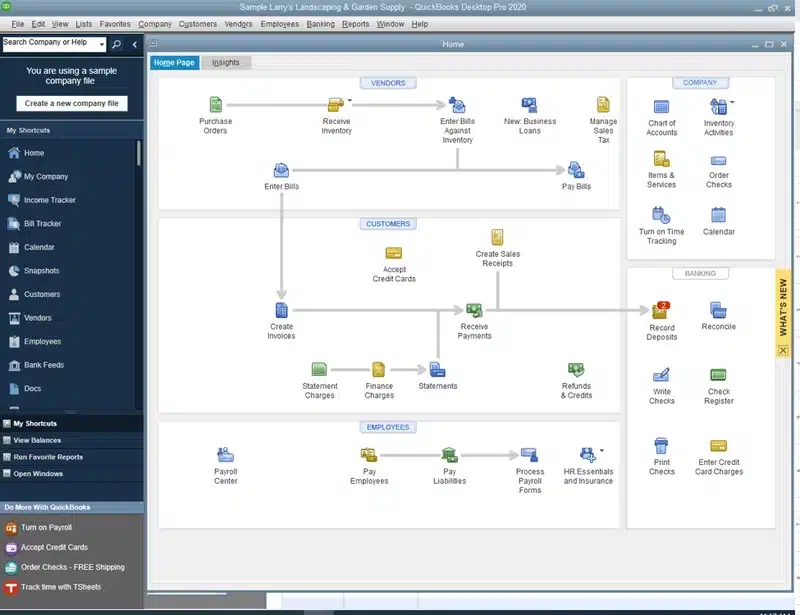

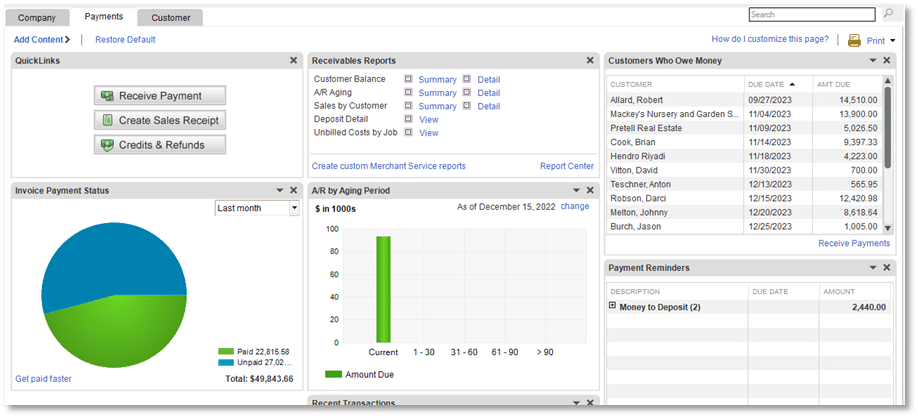

QuickBooks

Company: Intuit

Software Class: Pure Accounting

OVERVIEW

QuickBooks is by far the most well-known accounting software. And for good reason, it’s robust, powerful yet easy to use. QuickBooks is not law-firm-specific, so while a great application, it may lack some of the legal-specific functions your firm requires.

QuickBooks comes in both a Desktop and a Cloud-based (online) version.

QuickBooks Desktop is the classic, full-featured accounting software that runs on Windows PC’s. QuickBooks Online is Intuit’s cloud-based (web-based) edition, which provides much, but not all, of the classic Desktop functionality.

STAND-OUT FEATURES

- Easy to Use for Non-Accountants

- Easy Access for your Outside Accountant

- Desktop and Cloud Editions

PRICING

- QuickBooks Desktop: Starts at $199 / Year (3-User Package)

- QuickBooks Online (Essentials): Starts at $40 / User / Month

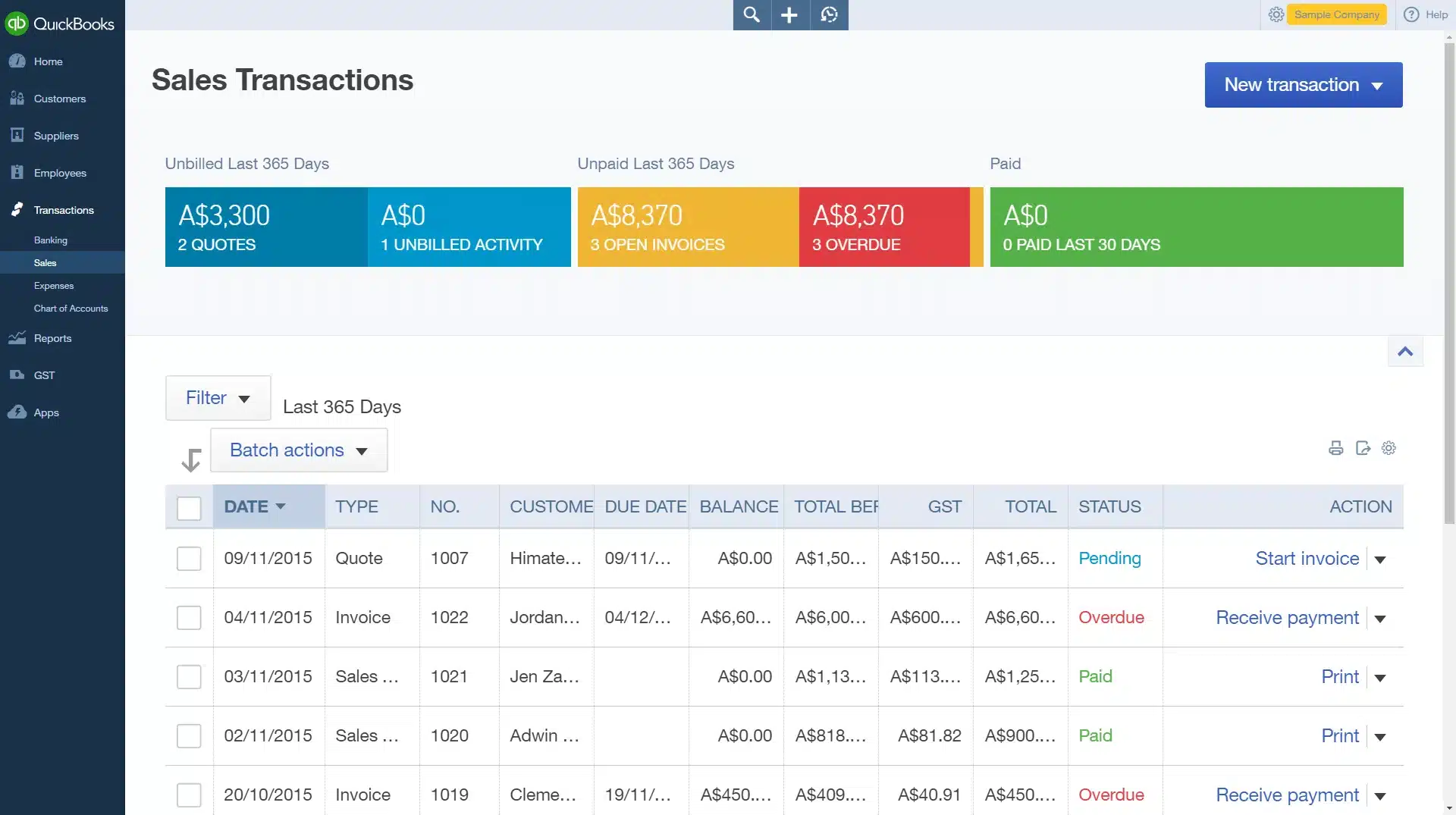

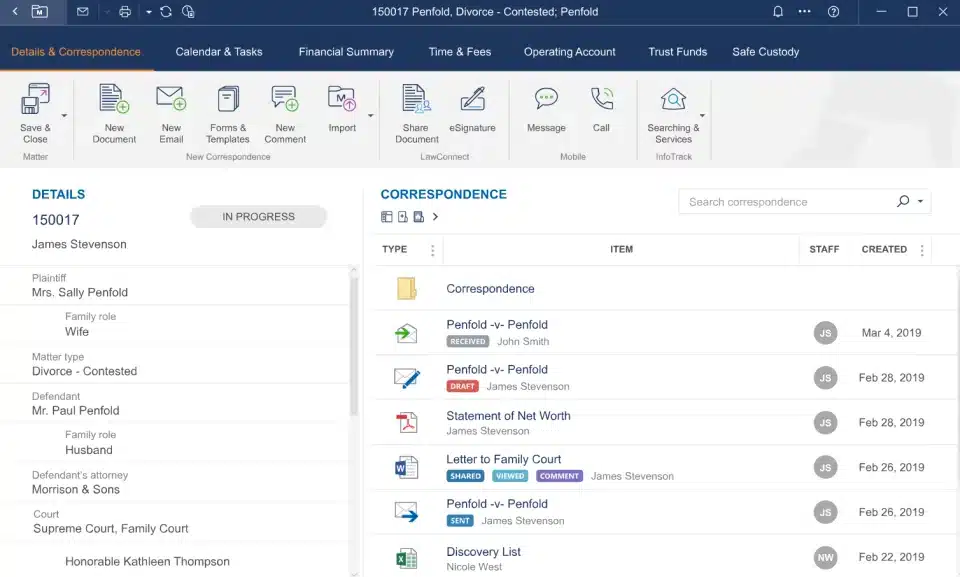

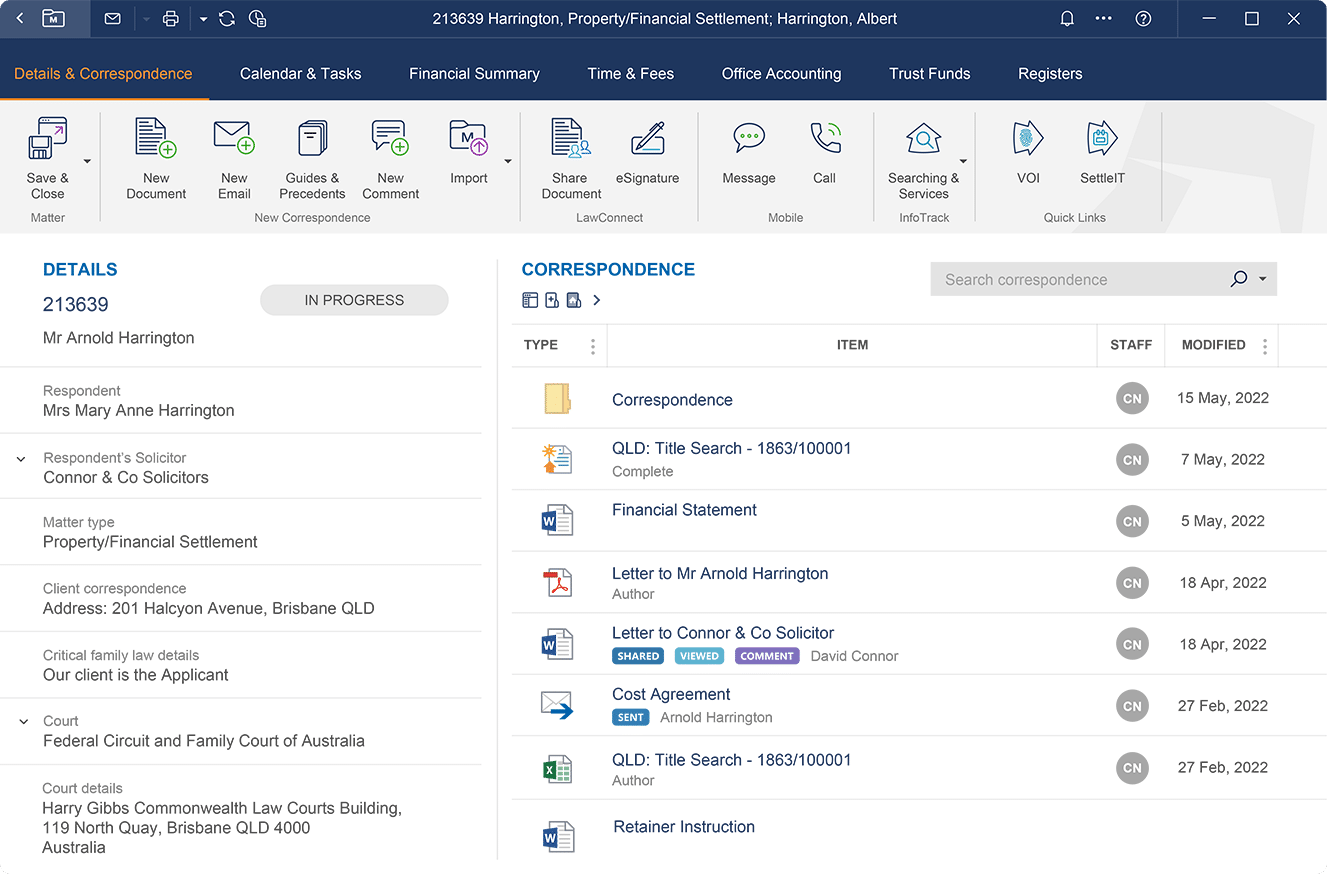

LEAP

Company: LEAP Software

Software Class: Practice Management + Accounting*

OVERVIEW

LEAP is robust, cloud-based practice management and legal billing software. LEAP is not a full-fledged accounting system (hence the asterisk [*]), but it provides powerful, flexible legal billing, trust accounting and reporting, so it’s worthy of a spot on this list, and certainly worthy of your consideration.

In addition to sophisticated law practice management and document assembly/form assembly features, LEAP provides time tracking, billing, trust accounting and financial reporting capabilities.

LEAP is unique in that it’s a hybrid-cloud solution. You install a lightweight desktop application on your Windows PC, but the core of the software (and data) is stored on LEAP’s cloud platform.

STAND-OUT FEATURES

- Comprehensive Billing

- Trust Accounting

- State-Specific Form Automation

- Client Web Portal

- Desktop, Web and Mobile Apps

PRICING

- Not provided by software publisher

- Contact vendor for more information

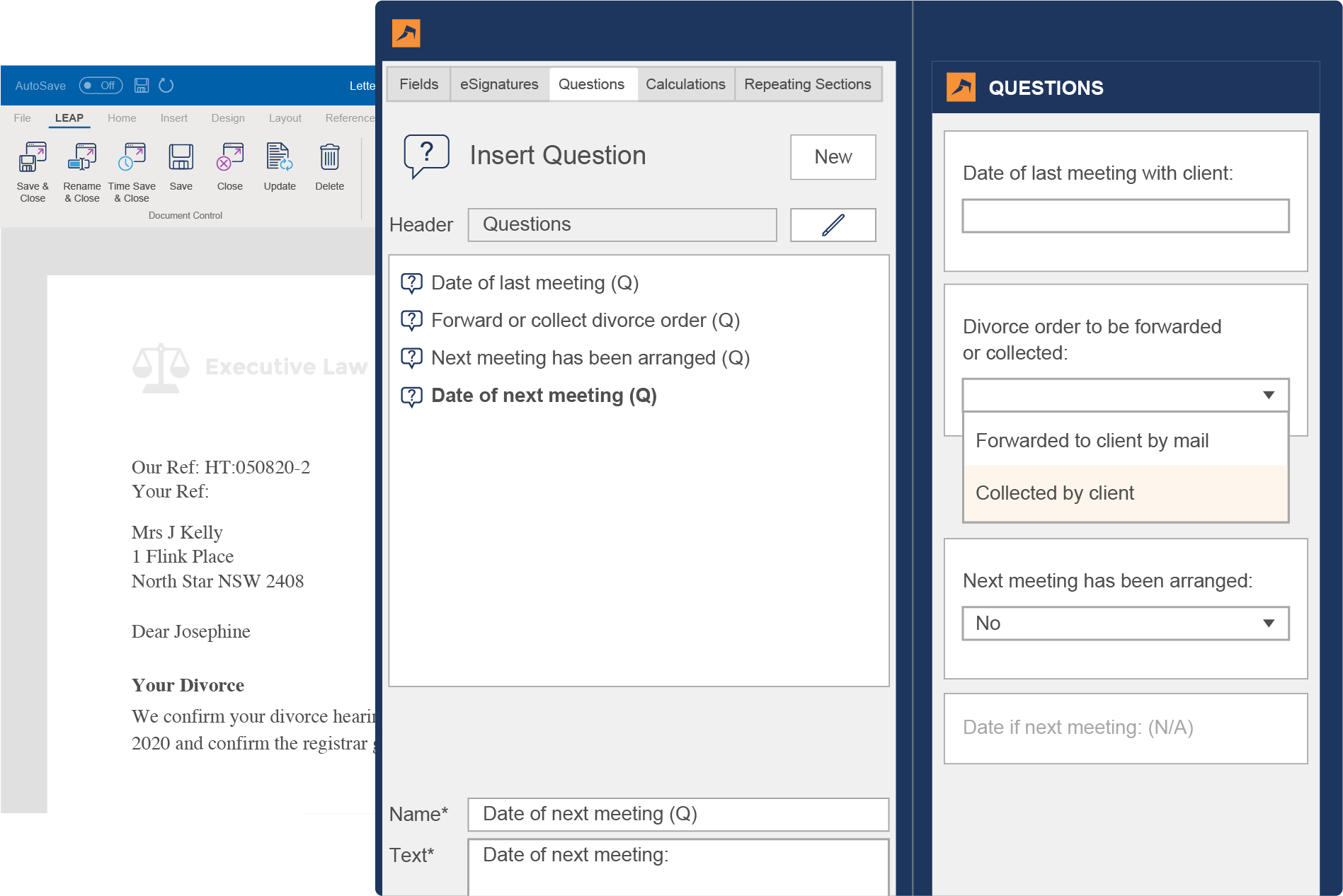

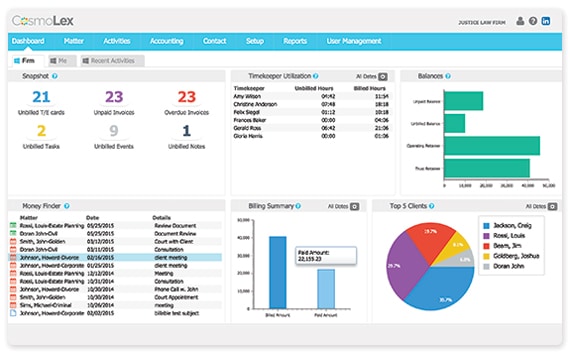

CosmoLex

Company: Software Technology, Inc.

Software Class: Practice Management + Accounting

OVERVIEW

CosmoLex was among the first cloud-based law practice management applications that includes complete, end-to-end accounting.

CosmoLex includes client and matter management, time, billing, business accounting and trust/IOLTA accounting, thereby eliminating the need for QuickBooks or other accounting software. With CosmoLex, the financials of every client/matter is front-and-center, and intrinsically linked to each case.

CosmoLex is cloud-based, which means you run the software from a web browser.

STAND-OUT FEATURES

- Integrated, full-fledged Business and Trust Accounting

- Financial Reports by Client and Matter

- Straight-forward Law Practice Management

PRICING

- $79 / User / Month (billed annually)

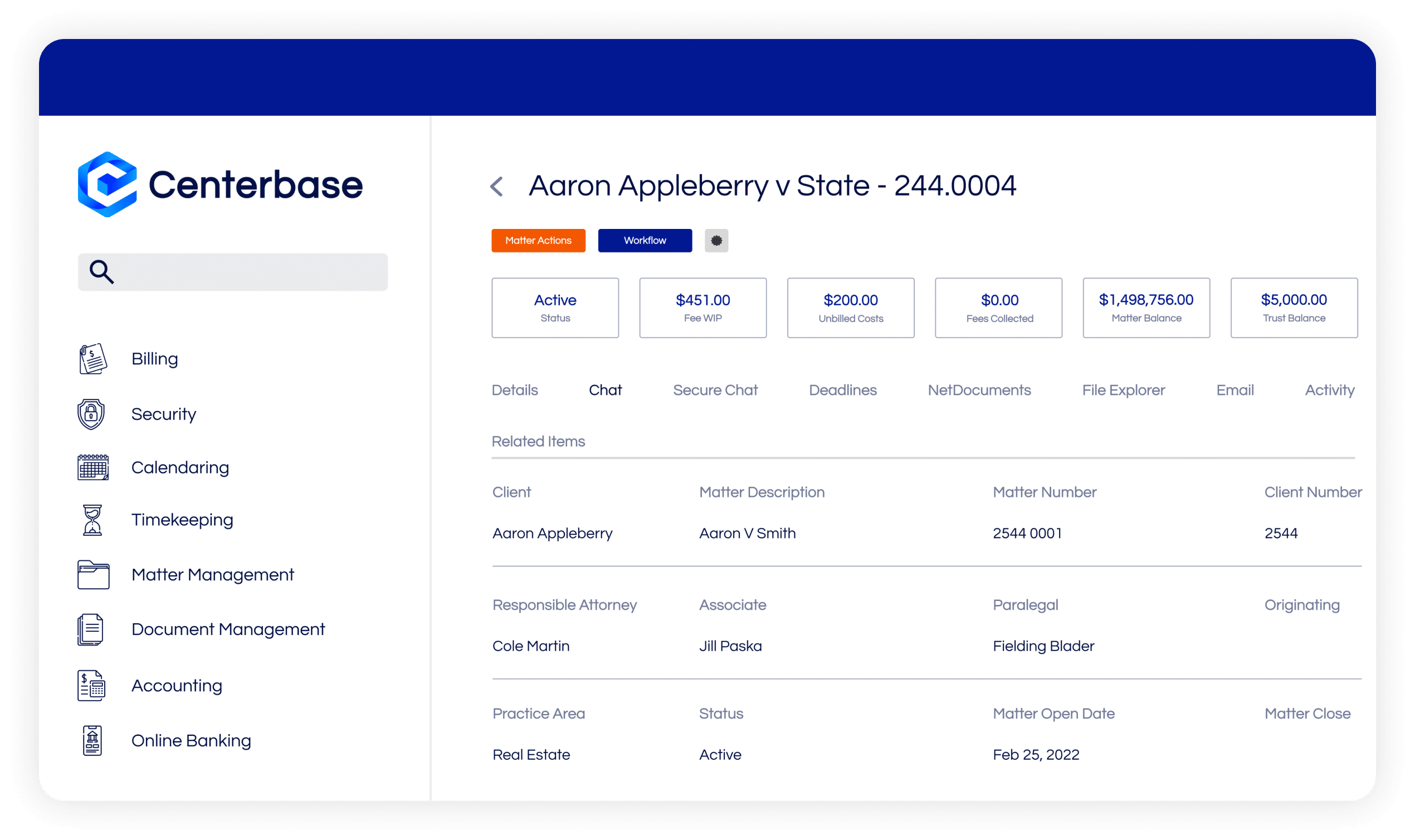

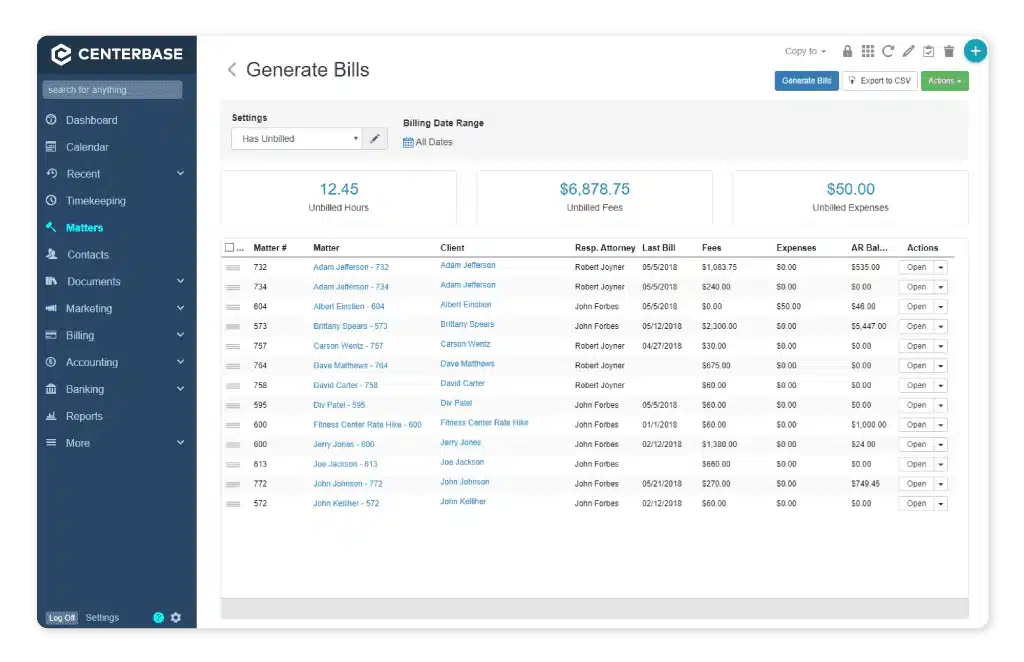

Centerbase

Company: Centerbase

Software Class: Practice Management + Accounting

OVERVIEW

Centerbase is a cloud-based Law Practice Management system. It provides time and billing, case and client management, and full-fledged accounting.

Centerbase is arguably one of the most customizable LPM applications, though that customization may require an outside consultant.

Centerbase describes its platform as “Mission Control for your Law Firm,” bringing together case/matter management, billing and complete accounting in a single, customizable platform.

STAND-OUT FEATURES

- Complete Business and Trust Accounting

- End-to-End Contact/Client/Matter Management

- Highly Customizable Workflows

PRICING

- Staff: $59 / User / Month

- Timekeeper: $79 / User / Month

- Billing + Accounting: $99 / User / Month

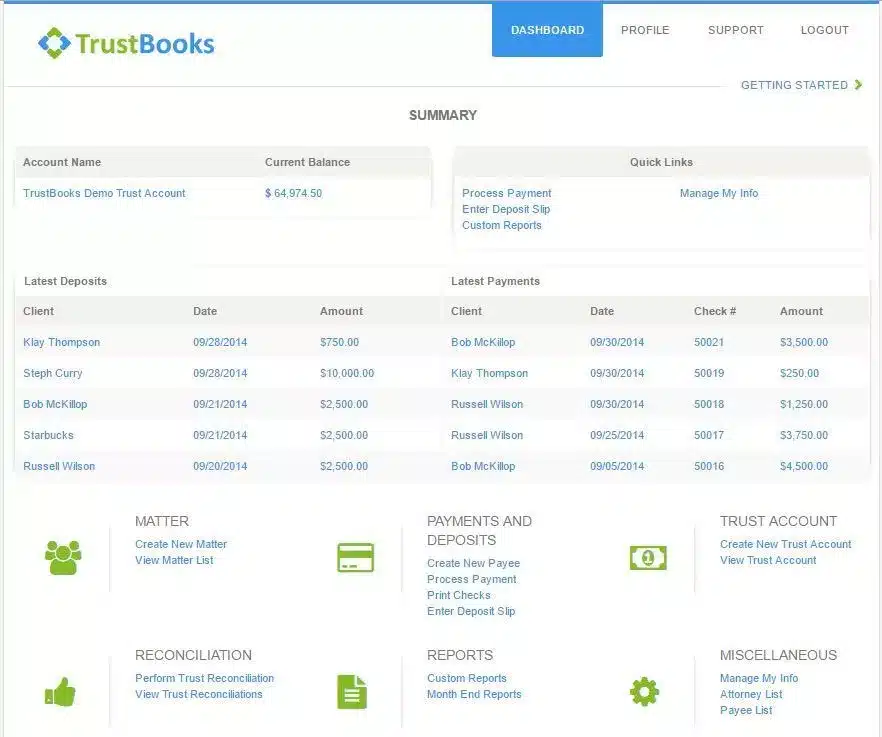

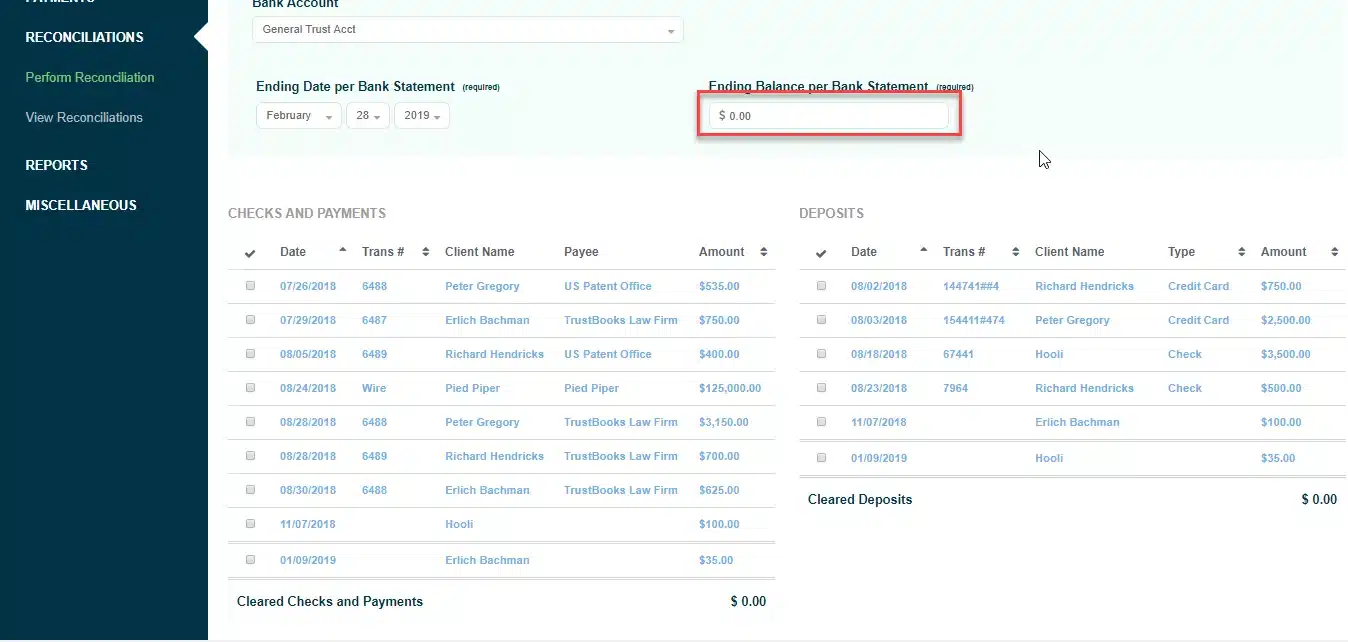

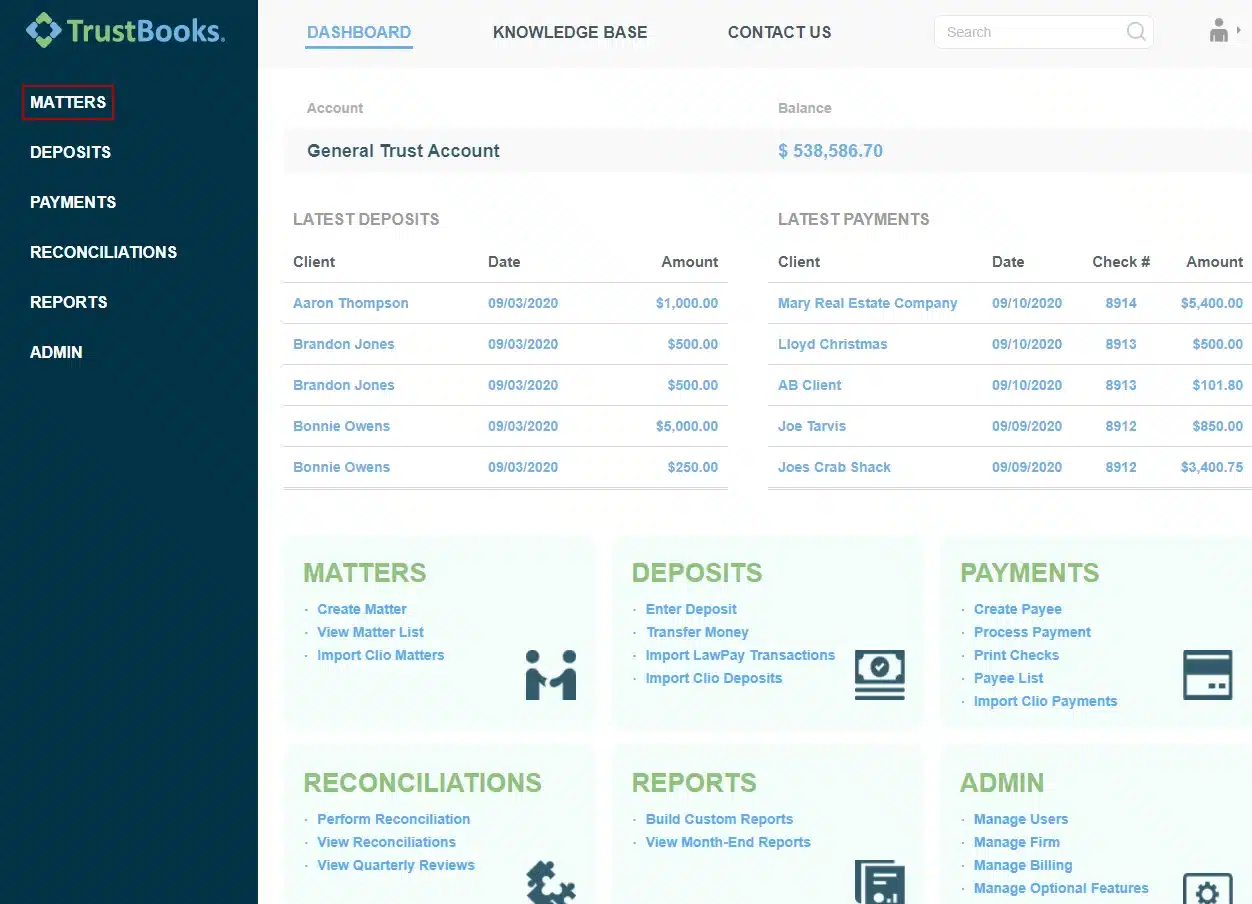

TrustBooks

Company: TrustBooks

Software Class: Dedicated Accounting Software

OVERVIEW

TrustBooks is unique in that it’s stand-alone software for Trust Accounting.

Many law firms use QuickBooks for their core accounting, but acknowledge that QuickBooks does not follow the rigid Trust Accounting rules. (Some law firms try anyway, or worse yet, use an Excel spreadsheet to manage trust accounts).

TrustBooks provides comprehensive Trust/IOLTA accounting with three-way reconciliation, trust audit reports and more. TrustBooks is cloud-based which means you run it from a web browser.

STAND-OUT FEATURES

- Detailed Client Ledgers

- Built-in Trust Controls

- Three-Way Trust Reconciliation

- Friendly for Non-Accountants

- State Bar Compliance

PRICING

- Tier One: $49 / Month

- Tier Two: $69 / Month

- Tier Three: $149 / Month

More Useful Software for Law Firms

In this article, we’ve covered the best law firm accounting software packages. In addition to accounting, your law firm likely needs other software.

We encourage you to learn more about other useful software for law firms.

Document Management Software

Document Management Software keeps your documents (and email) organized, searchable and accessible from anywhere.

Document Management software typically provides:

- Client/Matter-Centric Organization for Documents and Email

- Full-Text Search

- Microsoft Office Integration

- Email Management

- Document Tagging & Profiling

- Document Version Management

- Secure Cloud Storage

Related – Best Document Management Software: Having the optimal way to organize your documents leads to better organization, efficiency, and success.

Practice Management Software

As we described earlier, Practice Management software manages your firm’s clients, contacts, cases, and billing.

Practice Management software typically includes:

- Client & Contact Management

- Matter / Case Management

- Calendaring

- To-Do / Workflow

- Time Tracking

- Billing

Related – Best Law Practice Management Software: Manage your practice better by choosing the optimal software.

Frequently Asked Questions - Law Firm Accounting Software

Specialized accounting software is crucial for law firms as it caters to the unique financial and compliance needs of the legal industry.

It streamlines financial management, ensures accurate billing, and helps in maintaining compliance with legal accounting standards, allowing law professionals to focus more on their legal tasks.

Cloud-based solutions allow legal professionals to access financial data and manage accounts from anywhere, at any time, fostering enhanced flexibility and productivity.

Real-time updates and collaborative features enable seamless communication and efficient management of financial tasks, reducing the time spent on administrative duties.

Absolutely, most law firm accounting software is designed to manage trust accounts meticulously, ensuring compliance with legal standards.

It helps in tracking client funds separately, preventing commingling of funds, and automating reconciliation processes, thereby reducing errors and safeguarding client monies.

Cloud-based accounting software providers prioritize data security, employing advanced encryption and security protocols to protect sensitive information.

Regular backups and updates ensure data integrity and availability, making cloud-based solutions a reliable choice for law firms.

Law firm accounting software can potentially automate the creation of invoices, tracks billable hours efficiently, and allows customization of billing rates.

It ensures accurate and timely billing, supports multiple payment options, and helps in managing receivables, thereby improving cash flow and client satisfaction.

Yes, many accounting solutions offer integration capabilities with other legal management tools and software, providing a cohesive and streamlined experience.

Integration facilitates data synchronization, reduces manual data entry, and enhances workflow efficiency across various law firm operations.

Migrating to a new accounting software solution can seem daunting, but many providers offer support and resources to facilitate a smooth transition.

Detailed guides, customer support, and training sessions are often available to assist law firms in adapting to the new system efficiently.

Implementing cloud-based law firm accounting software is generally cost-effective as it reduces the need for substantial hardware investments and maintenance costs.

Subscription-based pricing models allow law firms to choose plans that suit their needs and budget, providing scalability and flexibility in managing financial resources.

Looking for Document Management Software?

LexWorkplace:

Modern Document Management for Law Firms

LexWorkplace is document & email management software, born in the cloud and built for law firms. Here’s a quick primer on how it works.

Organize by Client & Matter

Organize documents, email and notes by client or matter. Store and manage all data for a case or project in one place.

Go Beyond Basic Files & Folders

Supercharge your firm’s productivity with true DMS functions.

- Version Management

- Document Tagging & Profiling

- Document Check-Out / Check-In

- Microsoft Office Integration

- Automatic, Integrated OCR

- Convert Word Docs to PDF

Search Everything

LexWorkplace is like Google for your law firm. Search across millions of pages, documents, folder email and notes in seconds. Refine your search by matter, document type, author and more.

Search by…

- Client or Matter

- Document Type (Contract, Complaint, Order, etc.)

- Document Status (Draft, Final, etc.)

- Document Tags (Filed With Court, Fully Executed, etc.)

Outlook Integration + Comprehensive Email Management

Save emails to a matter without leaving Outlook. Saved emails are accessible to your entire team, organized and searchable.

- Outlook Add-In that Works With Windows and Macs

- Save Entire, Original Email to a Matter in a LexWorkplace

- Email De-Duplication

- Organize Emails into Folders, Subfolders

Works with Windows and Macs

All of LexWorkplace is compatible with both Windows and Mac computers.

What Clients Say

Lawyers love LexWorkplace. See how the system streamlined one lawyer’s practice.

Watch the 5-Minute Demo

See LexWorkplace in action in our quick 5-minute overview and demonstration.

Or, if you want a one-on-one demo, or want to talk about LexWorkplace for your firm, schedule a call or demo below.

You Might Also Like

April 10, 2024

Protected: Clio Draft Review

March 28, 2024

Law Firm Software: Your 2024 Guide to Building Your Tech Stack

Top Law Firm Software: Practice…

Want More Legal Technology Tips?

Subscribe to Uptime Legal to get the latest legal tech tips and trends, delivered to your inbox weekly.