Legal Billing Software: Modernizing Law Firm Finances

Law firms, whether large or small, are constantly juggling a myriad of tasks, from client consultations to courtroom appearances.

Amidst this whirlwind of activities, one administrative task stands out in its importance: billing.

Legal billing isn’t just about sending out invoices. It’s a complex process that involves tracking billable hours, managing client accounts, generating detailed reports, and ensuring timely payments.

In this article, we’ll explain:

- The Different Types of Legal Billing Software

- The Comparison Between Legal Billing and Practice Management

- How to Decide Between Server-Based or Cloud-Based Software

- How to Choose the Best Legal Billing Software for Your Firm

- Our List of the Top Legal Billing Software in 2023

Whether you’re a veteran in the legal field or a newcomer making your mark, grasping the significance of these digital tools can greatly enhance your firm’s efficiency and bolster client confidence.

In This Article

- Introduction to Legal Billing Software

- Legal Billing Software vs. Practice Management Software

- Differences Between Legal Billing, Accounting, and Payment Processing

- Complete List of Legal Billing Software Features

- The List - Best Legal Billing Software in 2023

- How to Choose Legal Billing Software

- On-Premise vs. Cloud-based Legal Billing Software

- Frequently Asked Questions - Legal Billing Software

Introduction to Legal Billing Software

Legal billing isn’t just about sending out invoices. It’s a complex process that involves tracking billable hours, managing client accounts, generating detailed reports, and ensuring timely payments.

With the average attorney invoicing only about 81% of actual billable hours, the margin for error and oversight is significant. This is where legal billing software comes into play.

What is Legal Billing Software?

Legal billing software is a specialized tool designed for attorneys and law firms to streamline and automate the billing process. At its core, this software aids in tracking consulting time, calculating billable hours, and generating invoices. But its functionalities don’t stop there.

Modern legal billing software offers a plethora of features, including:

- Time Tracking: Whether it's manual entries or automated tracking, these tools ensure every minute spent on a case is accounted for.

- Client Account Management: Keep track of client expenses, calculate accurate account receivables, and ensure transparency in financial dealings.

- Invoice Generation: Automatically consolidate billable hours and expenses to generate detailed and accurate invoices.

- Reporting: Gain insights into the firm's productivity, understand where time is spent, and make informed decisions for the future.

- Tax and Trust Accounting: Some software even assists with tax filings and managing Interest on Lawyer Trust Accounts (IOLTA).

Beyond these functionalities, legal billing software offers a centralized system, reducing the chances of human error, ensuring compliance with legal standards, and ultimately, ensuring a steady revenue flow for the firm.

In the digital age, as law firms evolve and adapt to new technologies, legal billing software has become an indispensable tool. It not only simplifies administrative tasks but also empowers law firms to focus on what they do best: practicing law.

“LexWorkplace is very fast, and documents are easily accessible. Working remotely is seamless.”

Nathan Cobb

Law Offices of Nathan Cobb

See Why Lawyers Love LexWorkplace

Get Organized. Work Anywhere. LexWorkplace is modern Document & Email Management, born in the cloud and built for law firms.

Related: Building Out Your Law Firm Tech Toolbox

Watch the talk with Uptime Legal and Clio on how to build out your law firm software toolkit.

Legal Billing Software vs. Practice Management Software

The legal industry, with its myriad complexities and nuances, requires tools that not only simplify operations but also enhance the quality of service delivery.

Legal Billing Software and Practice Management Software, while both designed to cater to this industry, serve distinct yet occasionally overlapping purposes.

Here’s a comprehensive exploration of their similarities, differences, and the broader implications for law firms:

Similarities

Centralized System

In an age where data is the new oil, both tools act as reservoirs.

They provide a centralized platform, ensuring that data isn't scattered across disparate systems but is instead consolidated, making it easier for law firms to access, analyze, and act upon this information.

Client Management

The legal profession is, at its heart, a service industry.

Both tools underscore this by offering robust client management features. They ensure that every piece of client-related information, from initial consultations to final billings, is meticulously organized, fostering better client relationships and enhancing service delivery.

Integration Capabilities

The digital ecosystem of a modern law firm is vast.

Recognizing this, both Legal Billing and Practice Management Software often come equipped with capabilities to integrate seamlessly with other tools.

This ensures a unified workflow, reducing the need for manual data transfers and minimizing the risk of errors.

Billing and Invoicing

Financial prudence is the cornerstone of a successful law firm.

Both tools, recognizing the importance of accurate and timely billing, offer features that streamline the invoicing process, ensuring that firms are adequately compensated for their services.

Differences

Core Focus

Legal Billing Software: This tool wears its heart on its sleeve. Its primary mission is to optimize the financial operations of a law firm. Every feature, every functionality, is designed with one goal in mind: to ensure that the firm's billing process is as efficient and accurate as possible.

Practice Management Software: This is the multitool of the legal world. While billing is certainly within its purview, its vision is broader. It aspires to be the digital command center of a law firm, orchestrating everything from document management to client communications.

Functionality Depth

Legal Billing Software: Specialization is its forte. It dives deep into the world of billing, offering features that might seem granular but are essential for legal professionals. For instance, it might allow for differential billing rates depending on the seniority of the attorney or the complexity of the task.

Practice Management Software: Its strength lies in its breadth. While it might not offer the depth of billing features that a specialized tool would, it compensates by providing a wide array of functionalities, ensuring that every operational aspect of a law firm is catered to.

Deployment and Customization

Legal Billing Software: Its deployment is typically more linear, given its specialized nature. While it might offer some customization, its primary focus remains on delivering a top-notch billing solution.

Practice Management Software: Flexibility is key here. Given its vast scope, it's designed to be malleable, allowing law firms to mold the software to fit their unique operational blueprints.

Implications for Law Firms

Choosing between Legal Billing Software and Practice Management Software isn’t merely a technical decision; it’s a strategic one. For boutique firms or those with a laser focus on refining their billing processes, a dedicated legal billing solution might resonate more.

However, expansive firms or those aiming for a digital overhaul might find the holistic approach of practice management software more aligned with their vision.

Related – Best Law Practice Management Software: Managing your practice starts with great software.

Is Practice Management Software Enough?

While Practice Management software excels in areas like time tracking, invoicing, and calendaring, its proficiency in handling documents and emails often leaves room for improvement. In this video, we introduce a more effective approach.

Related – Best DMS: Deciding on the best way to manage documents for your firm is imperative to good organization and overall workflow.

Differences Between Legal Billing, Accounting, and Payment Processing

Technology has paved the way for specialized software solutions, each designed to address distinct facets of a law firm’s financial management.

While there’s a natural overlap in functionalities, understanding the nuances of each software type is paramount for optimizing efficiency and ensuring accurate financial practices.

In this section, we’ll dissect the core differences between Legal Billing Software, Law Firm Accounting Software, and Law Firm Payment Processing Solutions, highlighting what sets each apart and how they collectively contribute to a law firm’s comprehensive financial strategy.

Let’s delve into the unique attributes of each.

Legal Billing Software

Legal Billing Software is tailored specifically for the invoicing and time-tracking needs of law firms. Its distinct features include:

- Billable Hours Tracking: Accurately logs hours spent on specific cases or clients.

- Customizable Invoicing: Allows for detailed invoices tailored to each client or case.

- Retainer Management: Manages retainer agreements and their respective drawdowns.

- Time and Expense Integration: Seamlessly combines time tracking and expense management for comprehensive billing.

- Client Management: Offers tools for managing client information and billing histories.

Law Firm Accounting Software

Distinguished by its comprehensive financial management capabilities, Law Firm Accounting Software offers:

- General/Business Accounting: Manages the firm's overall financial health, tracking revenues, expenses, and profits.

- Trust/IOLTA Accounting: Specialized tools for handling client funds held in trust, ensuring compliance with legal standards.

- Detailed Financial Reporting: Generates reports like balance sheets and profit & loss statements.

- Diverse Software Types: Ranges from pure accounting software to integrated practice management solutions.

- Integration Capabilities: Some versions can integrate with other practice management tools, offering a more holistic solution.

Related – Law Firm Accounting Software: Ensure that your firm keeps good accounts of invoices, payments, and more.

Law Firm Payment Processing Solutions

Focused on facilitating transactions, Law Firm Payment Processing Solutions provide:

- Diverse Payment Methods: Accepts payments via credit card, ACH, and other methods.

- Website Integration: Allows clients to pay directly from the law firm's website.

- Trust Accounting Compliance: Ensures that client payments align with trust accounting and IOLTA requirements.

- Automated Payment Options: Manages regular or automatic payments and custom payment plans.

- Transparent Fees: Clearly outlines processing fees, avoiding hidden charges.

- Tailored Solutions: Offers both general and legal-centric platforms, with the latter often better suited for handling legal trust accounting nuances.

Related – Law Firm Payment Processing: Know the best ways for your firm to process payments as they come in to ensure you’re getting paid properly.

While each software type offers features that cater to the financial operations of law firms, their primary functions differ.

Legal Billing Software zeroes in on invoicing and time-tracking, Law Firm Accounting Software provides a broader financial overview, and Law Firm Payment Processing Solutions streamline the transaction process.

Recognizing these distinctions is crucial for law firms aiming to optimize their operations.

Sidebar: Legal Document Management

Accounting software is an essential part of any law firm’s legal tech toolbox.

In addition, your firm may need to supplement your other legal software with a dedicated Document Management System to securely manage firm documents and email.

You might consider LexWorkplace, document management software born in the cloud, built for law firms.

- Securely Store & Manage Documents in the Cloud

- Client/Matter-Centric Document Organization

- Full-Text Search Across All Documents & Email

- Outlook Add-In: Save Emails to Matters

- Work with Windows and Mac OS

Considering LexWorkplace?

Watch This LexWorkplace Success Story

See how one law firm uses LexWorkplace to organize their documents and streamline their practice.

Book a 15-Minute Demo

Complete List of Legal Billing Software Features

Legal billing software has evolved over the years to cater to the multifaceted needs of law firms.

These tools are designed to streamline the billing process, ensuring accuracy, efficiency, and compliance. Here’s an exhaustive list of features that modern legal billing software might offer:

- Time Tracking: Accurately logs billable hours for various tasks and client cases.

- Expense Tracking: Monitors and categorizes expenses related to client cases.

- Invoice Generation: Automatically creates detailed invoices based on tracked hours and expenses.

- Client Account Management: Manages client expenses and provides financial transparency.

- Reporting: Offers insights into billing patterns, revenue streams, and areas of improvement.

- Trust Accounting: Manages Interest on Lawyer Trust Accounts (IOLTA) and ensures compliance.

- Payment Processing: Integrates with payment gateways for easy online payments.

- Late Fee Calculations: Automatically calculates and adds late fees to overdue invoices.

- Recurring Billing: Sets up recurring invoices for ongoing retainers or services.

- Client Portal: Provides clients with a secure portal to view and pay invoices.

- Automated Reminders: Sends automated reminders for unpaid or overdue invoices.

- Integration Capabilities: Integrates seamlessly with other tools like accounting software and CRMs.

These features, collectively, ensure that legal billing software not only simplifies the billing process but also adds layers of efficiency, accuracy, and compliance to it.

Depending on the specific needs of a law firm, some features might be more pivotal than others, but together, they paint a picture of a comprehensive billing solution.

The List - Best Legal Billing Software in 2023

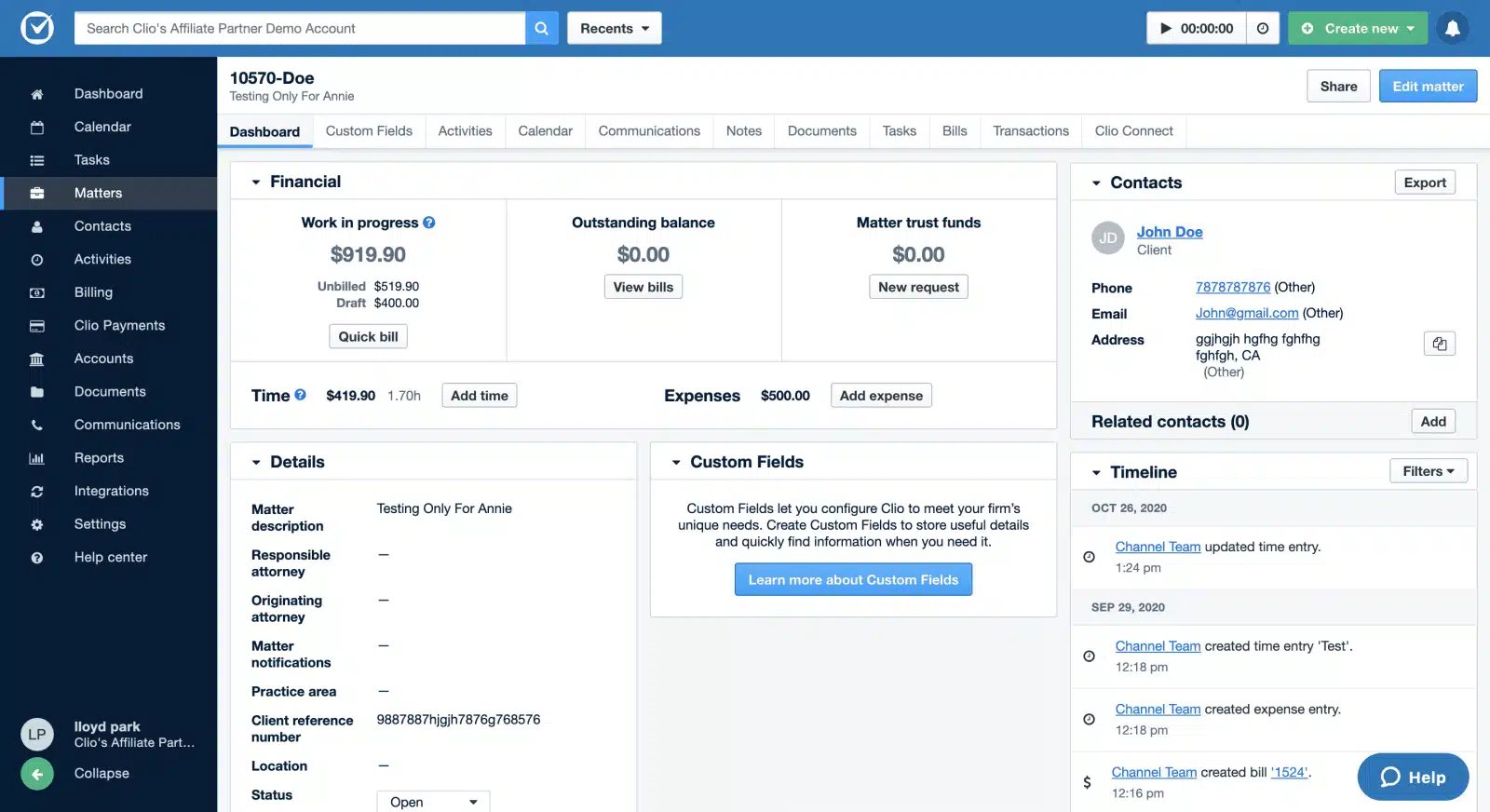

Clio Manage

Clio Manage is a comprehensive legal practice management solution designed to optimize law firm operations. It offers a centralized platform that covers a wide range of functionalities, from case management to billing, ensuring that law firms can work smarter and more efficiently.

Stand-Out Features

- Time & Expense Tracking: Clio provides robust features like Timekeeper and enhanced expense tracking, ensuring accurate billing.

- Client Portal: A dedicated app for clients to communicate and collaborate with their lawyer, enhancing client-lawyer interactions.

- Invoice Management: Offers functionalities like tracking unpaid bills, applying discounts, and accepting online payments.

- Reimbursable Expenses: Easily categorize and record reimbursable expenses.

- Security: Industry-leading security measures to protect client information and firm data.

Software Type: Full Practice Management

Deployment: Natively Cloud

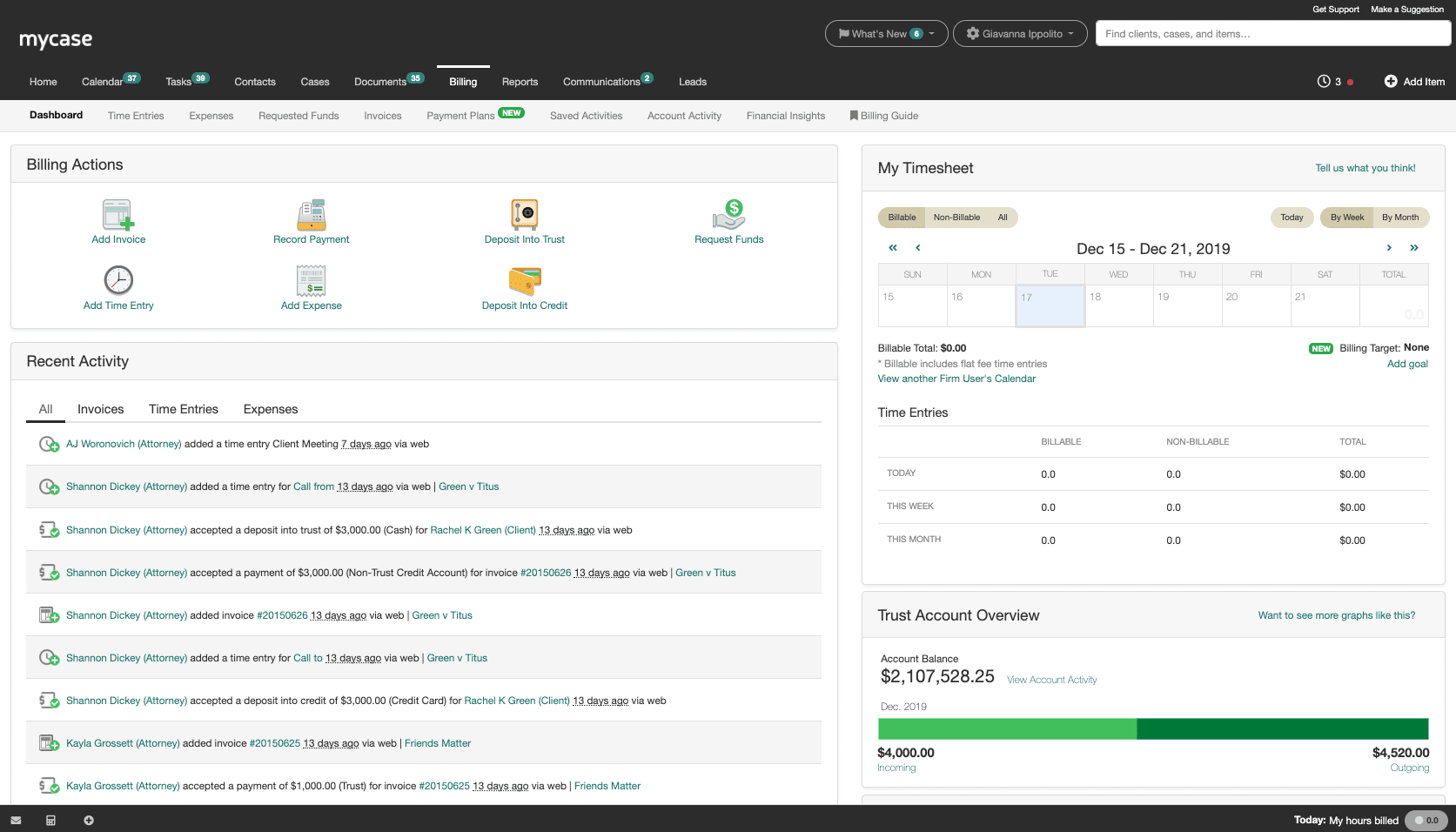

MyCase

MyCase is an all-in-one legal case management software designed to cater to the diverse needs of law firms. It provides a centralized platform that integrates case management, client communication, billing, and payments, ensuring that law firms can manage their operations efficiently and enhance client relationships.

Stand-Out Features

- Case Management: Centralizes all case details and documents, ensuring easy access and organization.

- Client Portal: A dedicated portal for clients to communicate, view documents, and make payments.

- Billing and Payments: Comprehensive tools for time tracking, invoicing, and payment collection, ensuring faster payments and improved cash flow.

- Financial Analytics Reports: Provides insights into the firm's performance, helping in making informed decisions.

Software Type: Full Practice Management

Deployment: Natively Cloud

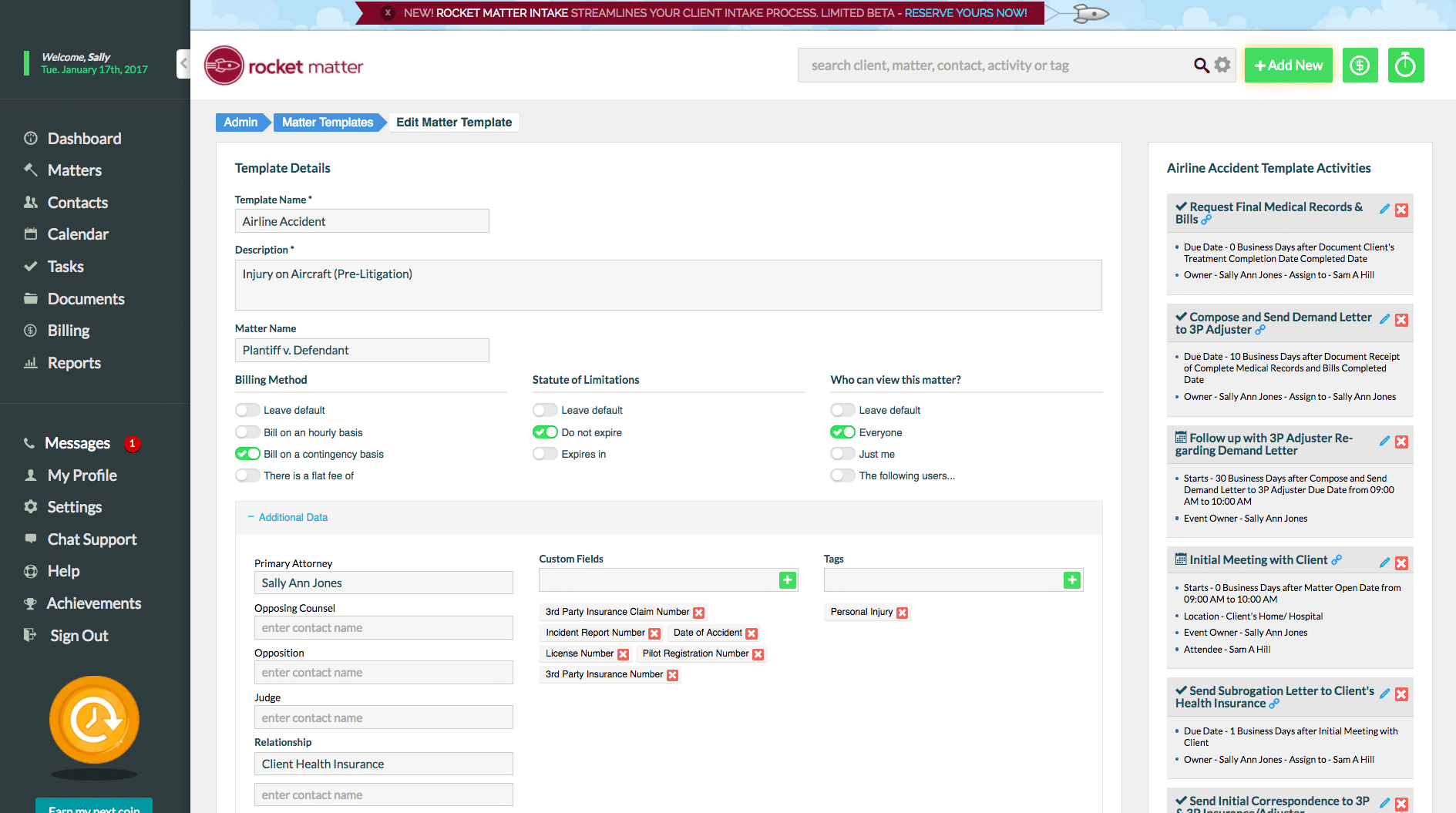

Rocket Matter

Rocket Matter is a comprehensive legal software solution designed to cater to the needs of modern law firms. It offers a unified platform that combines case management, billing, document management, and other essential features to streamline the operations of law firms of all sizes.

Stand-Out Features

- Legal Case Management & Reporting: A matter-centric approach ensures all entries are connected to the appropriate client matter. It also offers advanced reporting and analytics for better insights.

- Bill-As-You-Work™ Technology: Optimized for efficiency, this feature allows for intuitive time and expense capture from anywhere within the application.

- Workflows & Automation: Legal Project Management tools, matter templates, and automated billing ensure streamlined operations and reduced manual tasks.

- Online Invoicing & Payments: Streamlined invoicing, alternative fee arrangements, and integrated electronic billing facilitate faster payments.

Software Type: Full Practice Management

Deployment: Natively Cloud

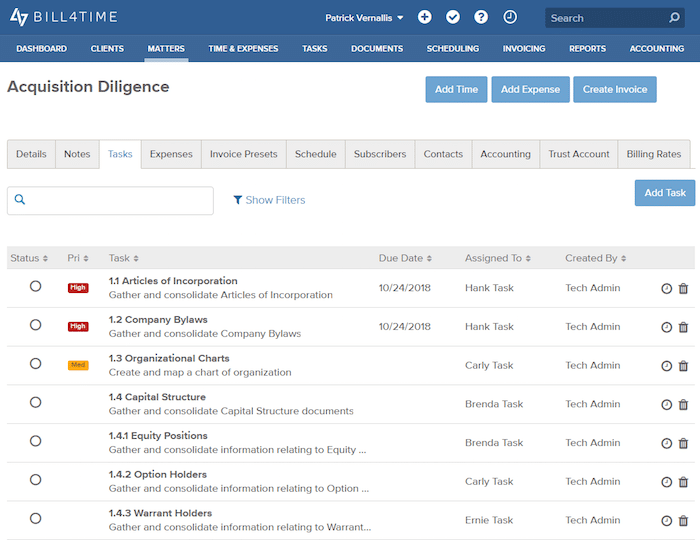

Bill4Time

Bill4Time is a dedicated time billing software designed to simplify and optimize the billing process for legal professionals. With a focus on time tracking and invoicing, Bill4Time ensures that law firms can accurately log their billable hours and expenses, generate detailed invoices, and manage their financial transactions seamlessly.

Stand-Out Features

- Time & Expense Tracking: Bill4Time offers robust tools to accurately track billable hours and categorize expenses, ensuring precise invoicing.

- Easy Invoicing: Streamlined invoice generation with customizable templates, facilitating prompt billing.

- Mobile Accessibility: Allows professionals to track time and manage billing on-the-go, ensuring no billable hour is missed.

- Client Portal: A dedicated portal for clients to view, download, and pay their invoices, enhancing client-lawyer transparency.

- Powerful Reporting: Provides insights into billing patterns, helping firms identify areas of improvement and optimize their billing processes.

- Integration Capabilities: Seamlessly integrates with other tools, enhancing workflow and reducing manual data entry.

Software Type: Pure Legal Billing

Deployment: Natively Cloud

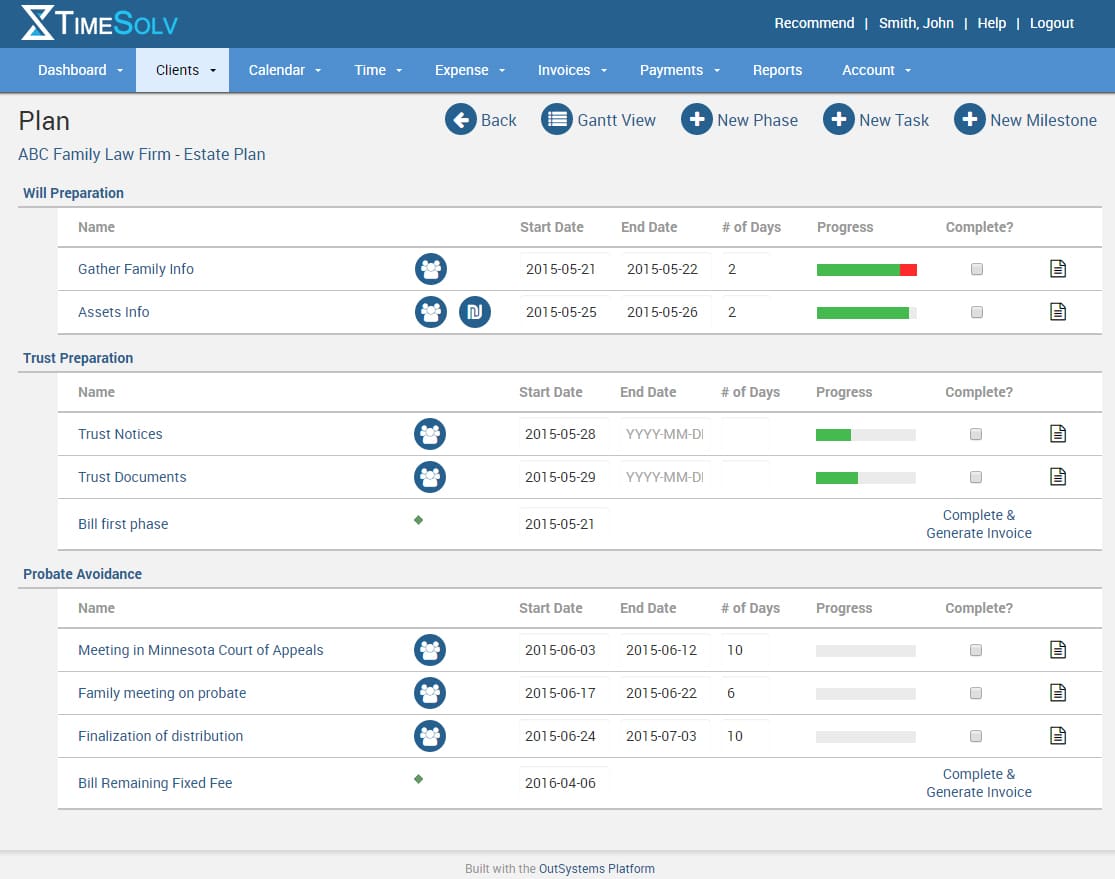

TimeSolv

TimeSolv is a dedicated legal billing software that emphasizes ease of use and efficiency. With over 20 years in the industry, TimeSolv has been designed to address the unique billing challenges faced by law firms, offering solutions that streamline time tracking, invoicing, and payment collection.

Stand-Out Features

- Time and Expense Tracking: Offers multiple ways to track time, both online and offline, ensuring accurate billing.

- TimeSolvPay: A feature that accelerates payments and reduces accounts receivable by integrating best-in-class credit card & ACH processing.

- Dynamic Dashboards: Provides real-time visibility into key metrics, allowing firms to make data-driven decisions and monitor progress.

- Data Security: Ensures all data is secured in the cloud, backed up every 10 minutes to two different locations, and transmitted using highly encrypted 256-bit SSL.

- Mobile App: Allows for time and expense entries on the go, even when offline, and facilitates the upload of expense receipts directly from mobile devices.

- Customizable Invoicing: Flexible billing templates allow firms to customize their invoices to display desired information in the preferred format.

Software Type: Pure Legal Billing

Deployment: Natively Cloud

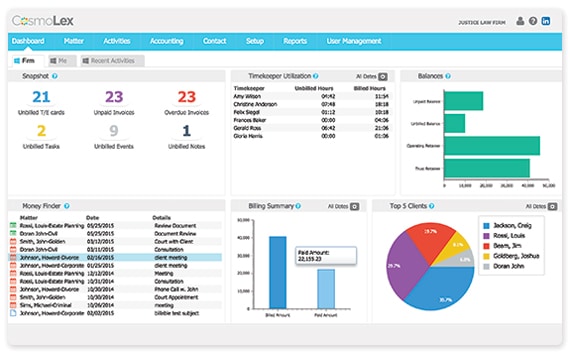

CosmoLex

CosmoLex offers a complete legal practice management solution for modern law firms. It emphasizes the integration of practice management essentials, legal billing, and law office accounting in one platform, eliminating the need for external accounting software.

Stand-Out Features

- Legal Case Management: A matter-centric system that optimizes calendar, document, and email management.

- Legal Billing and Payments: Features like on-the-go capture, Money Finder, one-click billing, and built-in electronic payments ensure efficient billing and faster payments.

- Law Office Accounting: Legal-specific trust and back-office accounting features, along with over 100 reporting options, ensure compliance and provide insights into the firm's performance.

- Client Intake and Relationship Management (CRM): Streamlines client intake, tracks prospective clients, and keeps current clients engaged.

- Timekeeping Tools: Mobile timers and the CosmoLex Money Finder help capture billable time efficiently.

Software Type: Billing + Accounting

Deployment: Natively Cloud

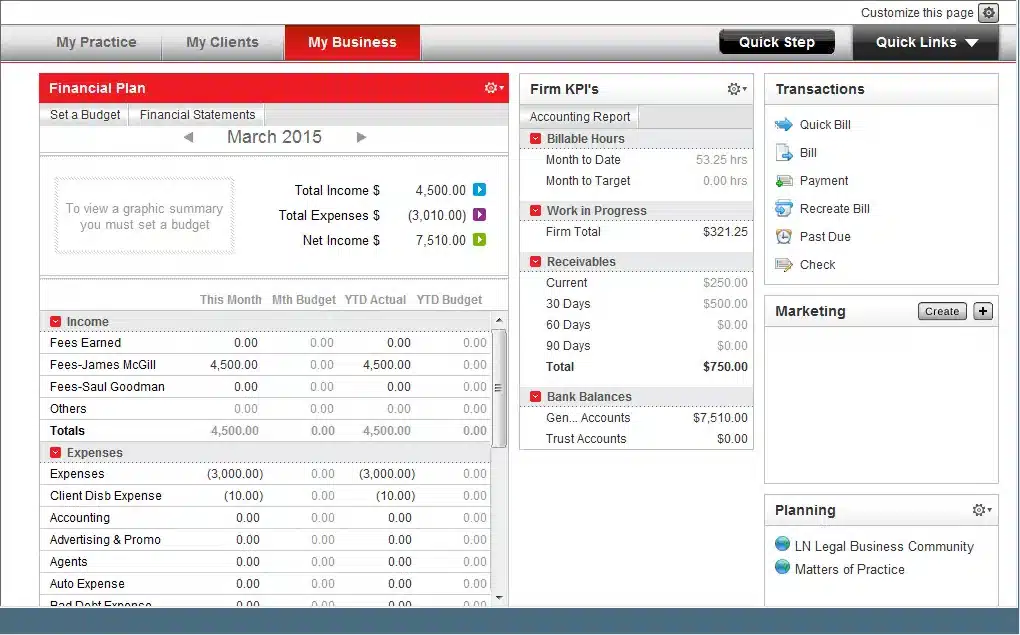

On-Premise Software

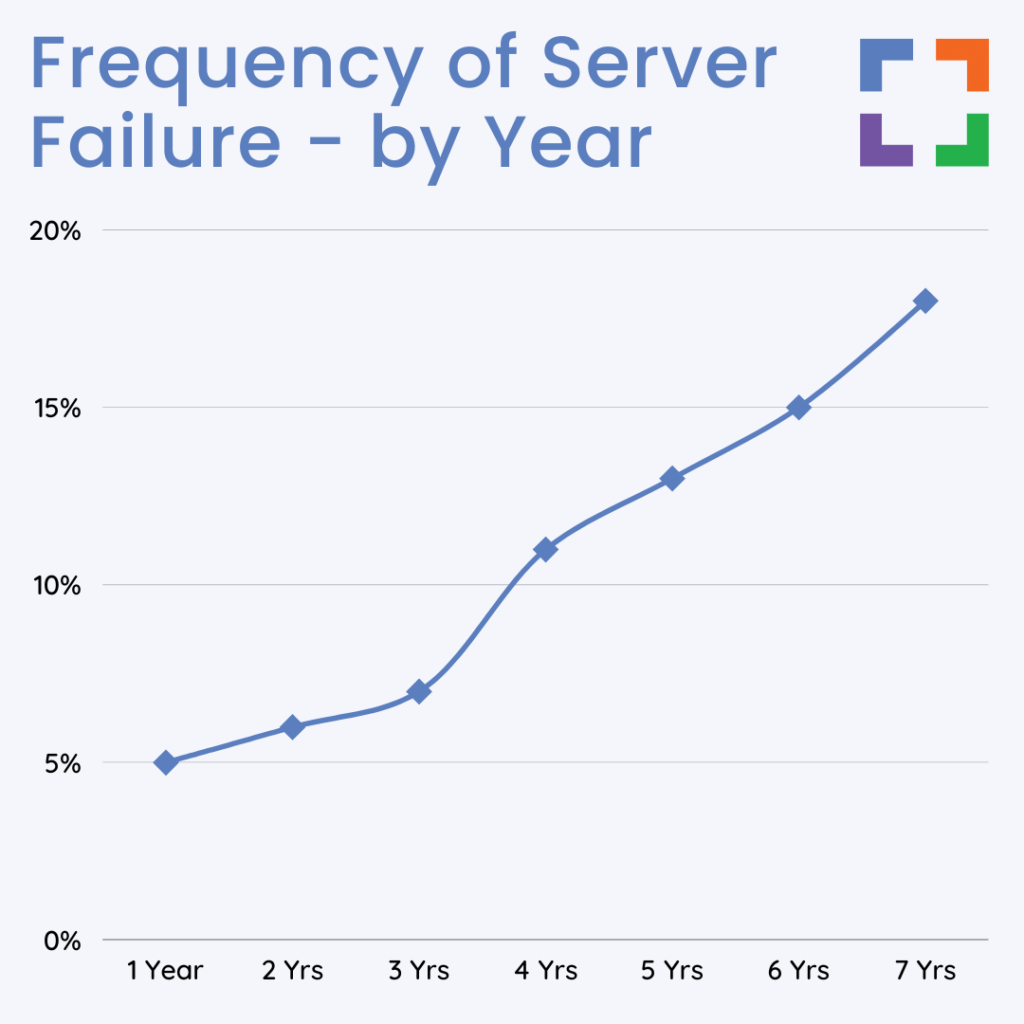

Server-based software can sometimes offer robust features that you can’t find through natively-cloud solutions. Or, perhaps you firm has used a particular on-premise software that you’ve become accustomed to.

The good news?

With Uptime Practice, you don’t have to sacrifice your favorite software in pursuit of the cloud. Uptime Practice offers various hosting solutions that are built for just this type of scenario.

To learn more, click on the button “Hosting Options” under the following apps.

PCLaw

PCLaw | Time Matters is a comprehensive legal software solution that has been serving the legal community for over three decades. It offers an integrated suite of tools designed to assist law firms in managing matter information, billing, trust accounts, calendar appointments, tasks, time, and expenses from a single platform.

Stand-Out Features

- Matter Management: Centralized relational databases manage various information and their relationships, connecting all contact details, case notes, documents, time entries, and more.

- Time Tracking & Entry: Efficient tools for tracking billable hours and ensuring accurate invoicing.

- Billing and Accounting: Streamlined billing processes combined with legal-specific accounting features.

- Trust Account Management: Ensures compliant management of client trust and IOLTA accounts.

- Mobile Options: Tools like PCLaw® Go and Time Matters® Go provide functionalities for working remotely.

Software Type: Billing + Accounting

Deployment: On-Premise/Hosted

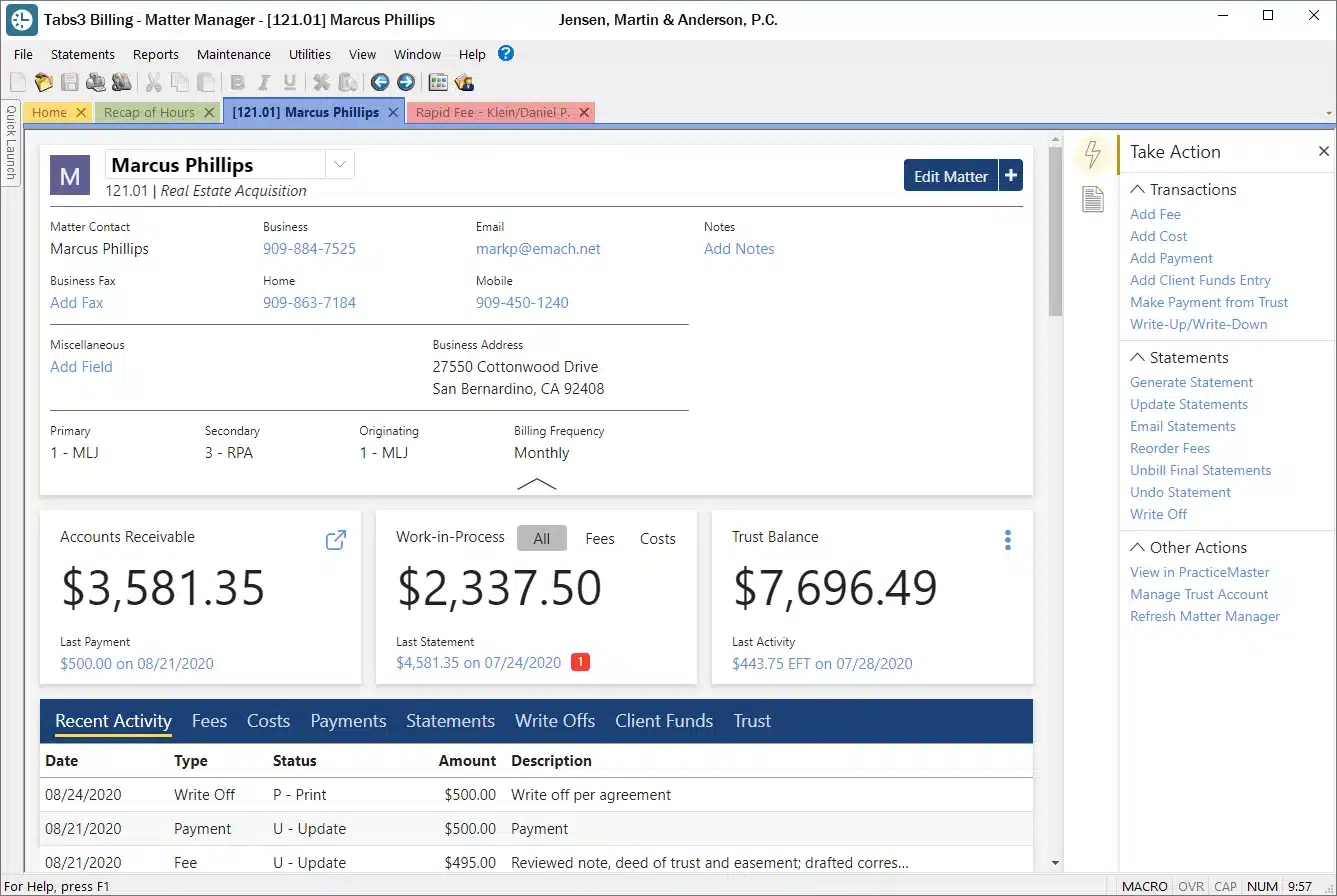

Tabs3

Tabs3 is a comprehensive legal practice management software that has been serving law firms for over 40 years. It offers an integrated suite of products designed specifically for law firms, ranging from billing to practice management, check writing to general ledger and trust accounting.

Stand-Out Features

- Tabs3 Billing: Facilitates quick and easy billing, allowing customization of statements and providing insightful management reports. It also offers mobile access with the Platinum Edition.

- Tabs3 Financials: Designed specifically for law firms, it meets all accounting requirements, from printing financial statements to managing client trust accounts.

- PracticeMaster: Goes beyond the capabilities of Outlook by providing an electronic case file that organizes each matter's contacts, appointments, emails, documents, fees, and research.

- Tabs3Pay: Allows clients to pay their bills online and make deposits to Trust Accounting conveniently.

Software Type: Billing + Accounting

Deployment: On-Premise/Hosted

How to Choose Legal Billing Software

Choosing the right legal billing software for your law firm is a critical decision that can significantly impact your firm’s efficiency, client satisfaction, and bottom line. With a plethora of options available in the market, making an informed choice can be daunting.

Here’s a step-by-step guide to help you navigate this decision:

Understand Your Needs

Before diving into the myriad of options, take a moment to assess your firm’s specific needs.

Are you looking for a standalone billing solution, or do you need a comprehensive practice management system? How many users will need access? Do you require mobile access?

Having the answers to these questions and more will put you in a strong position to have the best judgment for your firm.

Budget Considerations

Determine a budget for your software investment.

While it’s essential to find a solution that fits within your financial constraints, it’s equally crucial to ensure that the software offers value for its cost.

Features and Functionality

List down the must-have features.

Common functionalities to consider include time tracking, invoicing, expense tracking, trust accounting, integration with accounting software, and reporting capabilities.

Integration Capabilities

If you’re already using other software tools, such as accounting software or a client management system, ensure that the billing software you choose can seamlessly integrate with them.

This will streamline processes and reduce manual data entry.

Deployment Options

Decide whether you prefer a cloud-based solution that you can access from anywhere or an on-premise solution that’s installed on your firm’s servers.

Each has its pros and cons, so weigh them based on your firm’s operational needs.

User Experience

Opt for software that’s user-friendly and intuitive. A steep learning curve can hinder adoption rates among your staff.

If possible, request a demo or a trial period to get a feel for the software’s interface.

Security and Compliance

Given the sensitive nature of legal data, ensure that the software adheres to industry-standard security protocols.

Additionally, it should be compliant with regulations, especially if it handles trust accounting.

Customer Support

Reliable customer support can be a lifesaver, especially during the initial stages of software adoption.

Check if the provider offers timely support through multiple channels like email, phone, or chat.

Reviews and Recommendations

Look for reviews from other law firms or legal professionals who’ve used the software.

Personal recommendations can also provide insights into the software’s real-world performance.

Scalability

As your firm grows, your software needs might evolve.

Choose a solution that can scale with you, whether that means handling more clients, integrating with other tools, or offering advanced features.

Selecting the right legal billing software requires a blend of introspection about your firm’s needs and thorough market research.

By considering the factors mentioned above and leveraging trials or demos, you can find a solution that not only meets your current requirements but also supports your firm’s growth in the future.

Consider the Cloud

Maybe you prefer server-based software but wish to avoid the complexities of server maintenance. Makes sense!

No matter your accounting software choice, Uptime Practice is here to assist with hosting.

With our Private Cloud, you can access your desktop-based legal tools, documents, and data seamlessly. Enjoy the cloud’s benefits of reliability, security, and mobility without giving up your preferred software. Reach out to our experts to discover more.

Move Your Legal Software to the

Cloud with Uptime Practice

- Cloudify Your Legal Software

- Expert Legal Software Hosting

- Cloud Storage for Documents + Data

- End-to-End Security

- Office 365 + IT Support (Optional)

Related – Private Cloud for Law Firms: Eliminate Servers. Work Anywhere.

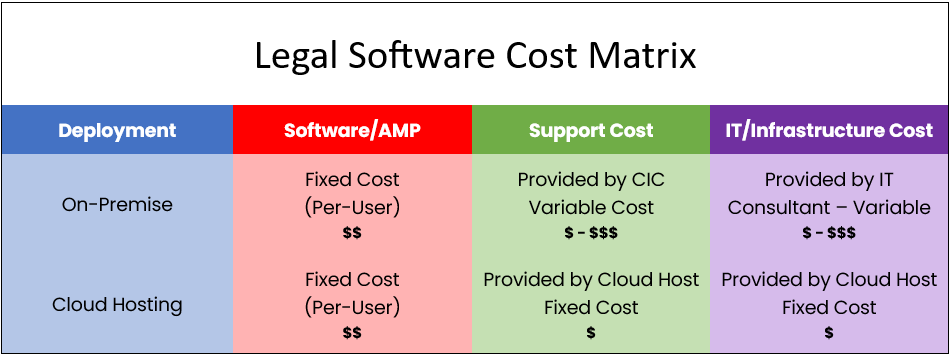

On-Premise vs. Cloud-based Legal Billing Software

In the realm of legal billing software, one of the primary decisions law firms face is choosing between on-premise and cloud-based solutions. Both options come with their own set of advantages and challenges.

Here’s a comprehensive comparison to help you make an informed decision:

On-Premise Legal Billing Software

On-premise software is installed and run on computers on the premises (in the building) of the organization using the software, rather than at a remote facility, such as a server farm or cloud.

Advantages

- Complete Control: Firms have absolute authority over their data, configurations, and the timing of updates, ensuring that changes align with internal schedules and needs.

- Deep Customization: Given the direct access to the software's infrastructure, firms can tailor the software extensively, adapting it to very specific requirements.

- Fixed Costs: Typically involves a one-time purchase or licensing fee. While this can be substantial upfront, it might be cost-effective over an extended period if the software remains unchanged.

Challenges

- Initial Investment: Requires a significant outlay for server infrastructure, software licenses, and sometimes specialized IT personnel.

- Maintenance Responsibility: All responsibilities, from software updates to security patches and hardware malfunctions, fall on the firm.

- Limited Scalability: Expanding the system, whether adding storage or users, often necessitates further investment in hardware or software licenses.

- Restricted Accessibility: The software is primarily accessible from the firm's location. Setting up secure remote access can be complex and costly.

Cloud-Based Legal Billing Software

Cloud-based software, or Software as a Service (SaaS), is hosted on external servers managed by third-party providers and is accessed via the internet.

Advantages

- Universal Accessibility: The cloud allows for access from any location with internet connectivity, making it ideal for firms with multiple locations or those supporting remote work.

- Cost Efficiency: Eliminates the need for hefty initial investments in hardware. Subscription models spread out costs and often include updates and support.

- Automatic Updates & Backups: Providers handle maintenance, ensuring the software is always up-to-date. Regular backups protect against data loss.

- Easy Scalability: Adjusting to growth or contraction is as simple as changing subscription tiers. There's no need to worry about server capacity or software licenses.

- Robust Security: Leading cloud providers invest in top-tier security measures, including encryption, firewalls, and regular audits, often surpassing what individual firms could afford.

Challenges

- Recurring Costs: Subscription fees are ongoing, and over an extended period, the cumulative costs can be substantial.

- Reliance on Internet: A stable and fast internet connection is paramount. Downtime or slow speeds can hinder access.

- Potential Data Sovereignty Issues: Data stored in the cloud might reside in servers located in different jurisdictions, which could raise compliance or legal concerns.

- Possible Customization Limits: While many cloud solutions offer a range of configuration options, there might be constraints compared to on-premise solutions.

Making the Decision

The choice between on-premise and cloud-based hinges on several factors:

- Budgetary Constraints: Consider both immediate and long-term financial implications. While on-premise solutions might have higher upfront costs, cloud solutions involve ongoing expenses.

- Operational Needs: Does your firm require extensive customization? Is remote access a priority? Answering such questions can guide your choice.

- IT Infrastructure: Firms with robust IT departments might find it easier to manage on-premise solutions, while smaller firms without IT expertise might benefit from the managed nature of cloud solutions.

- Future-Proofing: The legal industry, like all sectors, is evolving. Cloud solutions tend to adapt more quickly to technological advancements, ensuring firms remain at the cutting edge.

There’s no one-size-fits-all answer.

Each firm must weigh the pros and cons in the context of its unique operational landscape, financial situation, and future aspirations. Whatever the choice, the goal is to enhance efficiency, client service, and profitability.

Frequently Asked Questions - Legal Billing Software

Legal billing software is a specialized tool designed for law firms and legal professionals to track billable hours, manage expenses, generate invoices, and handle other financial aspects related to client cases.

While general billing software caters to a broad range of industries, legal billing software is tailored to the unique needs of the legal profession. It often includes features like trust accounting, case management integration, and compliance with legal industry standards.

Legal billing software streamlines the billing process, ensuring accuracy and efficiency. It helps law firms track billable hours, manage expenses, and generate detailed invoices, reducing administrative overhead and improving cash flow.

Yes, many legal billing software solutions offer integration capabilities with other tools, such as accounting software, case management systems, and even email platforms. This integration ensures seamless data flow and reduces manual data entry.

Reputable cloud-based legal billing software providers prioritize security. They often employ advanced encryption, regular backups, and other security protocols to protect sensitive client data. However, it’s essential to review the security features and certifications of any software before adoption.

Trust accounting refers to the management of funds that clients provide to law firms in trust, to be used for specific purposes like retainer fees or case expenses. Not all legal billing software solutions support trust accounting, but many tailored for the legal industry do, given its importance in legal financial management.

Most legal billing software solutions allow firms to set multiple billing rates. This flexibility caters to different attorneys, paralegals, or case types within the same firm. Whether it’s hourly rates, flat fees, or contingency fees, the software can accommodate various billing structures, ensuring accurate invoicing.

Yes, many legal billing software solutions come with features that enhance client communication. They can generate detailed billing statements, provide portals for clients to view their invoices and payment history, and even send automated reminders for upcoming or overdue payments. This not only streamlines the billing process but also fosters transparency and trust between law firms and their clients.

Looking for Document Management Software?

LexWorkplace:

Modern Document Management for Law Firms

LexWorkplace is document & email management software, born in the cloud and built for law firms. Here’s a quick primer on how it works.

Organize by Client & Matter

Organize documents, email and notes by client or matter. Store and manage all data for a case or project in one place.

Go Beyond Basic Files & Folders

Supercharge your firm’s productivity with true DMS functions.

- Version Management

- Document Tagging & Profiling

- Document Check-Out / Check-In

- Microsoft Office Integration

- Automatic, Integrated OCR

- Convert Word Docs to PDF

Search Everything

LexWorkplace is like Google for your law firm. Search across millions of pages, documents, folder email and notes in seconds. Refine your search by matter, document type, author and more.

Search by…

- Client or Matter

- Document Type (Contract, Complaint, Order, etc.)

- Document Status (Draft, Final, etc.)

- Document Tags (Filed With Court, Fully Executed, etc.)

Outlook Integration + Comprehensive Email Management

Save emails to a matter without leaving Outlook. Saved emails are accessible to your entire team, organized and searchable.

- Outlook Add-In that Works With Windows and Macs

- Save Entire, Original Email to a Matter in a LexWorkplace

- Email De-Duplication

- Organize Emails into Folders, Subfolders

Works with Windows and Macs

All of LexWorkplace is compatible with both Windows and Mac computers.

What Clients Say

Lawyers love LexWorkplace. See how the system streamlined one lawyer’s practice.

Watch the 5-Minute Demo

See LexWorkplace in action in our quick 5-minute overview and demonstration.

Or, if you want a one-on-one demo, or want to talk about LexWorkplace for your firm, schedule a call or demo below.

You Might Also Like

April 10, 2024

Protected: Clio Draft Review

March 28, 2024

Law Firm Software: Your 2024 Guide to Building Your Tech Stack

Top Law Firm Software: Practice…

Want More Legal Technology Tips?

Subscribe to Uptime Legal to get the latest legal tech tips and trends, delivered to your inbox weekly.